-

-

TSP F Fund 2021

-

-

-

-

-

TSP F fund

TSP F fund 2021

Key Consideration: Price moves opposite of going interest rates (interest rate risk)

Key Consideration: The F fund is dominated today by Treasuries and Gov't back securities, but also has investment grade corporate bonds with some risk (default risk)

Key Consideration: US interest rates declined for 40 years and have little room left to move lower (no more capital gains) so we are stuck with low yields... and risk

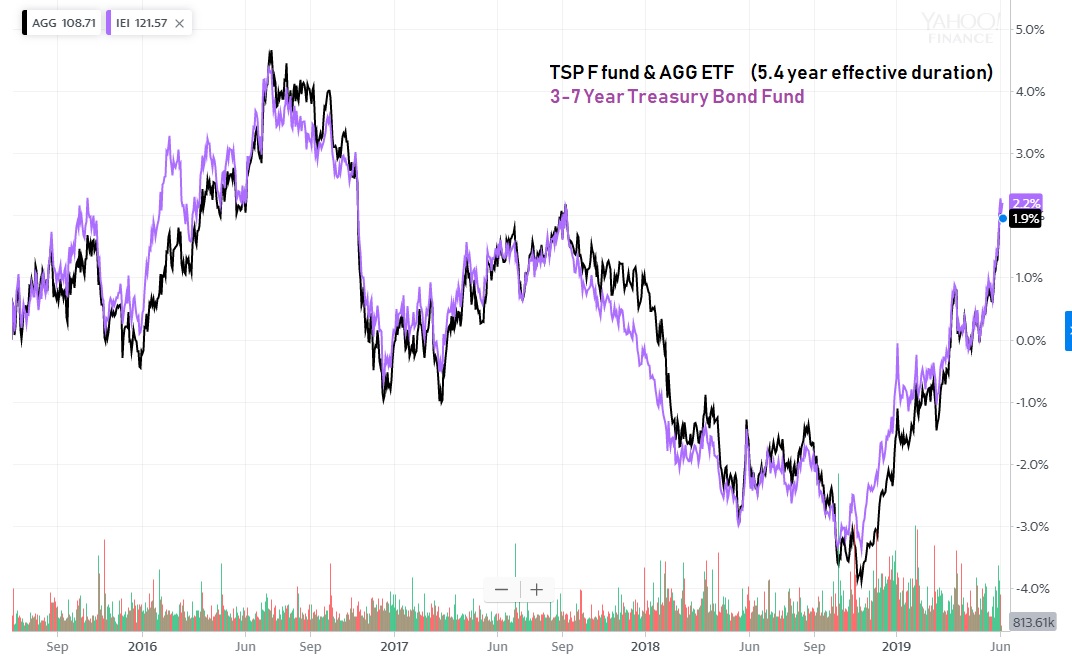

The black plot in the following chart represents the price-only action of the TSP F fund. I overlaid a Treasury fund which holds bonds which average pretty close to the TSP F fund's effective duration of 7 years. What we are seeing in the ups and downs are the effects on the fund's price from the ups and downs of interest rates. Price moves opposite of interest rates. In late 2018, interest rates dropped leading to a rising price due to capital gains within the fund.

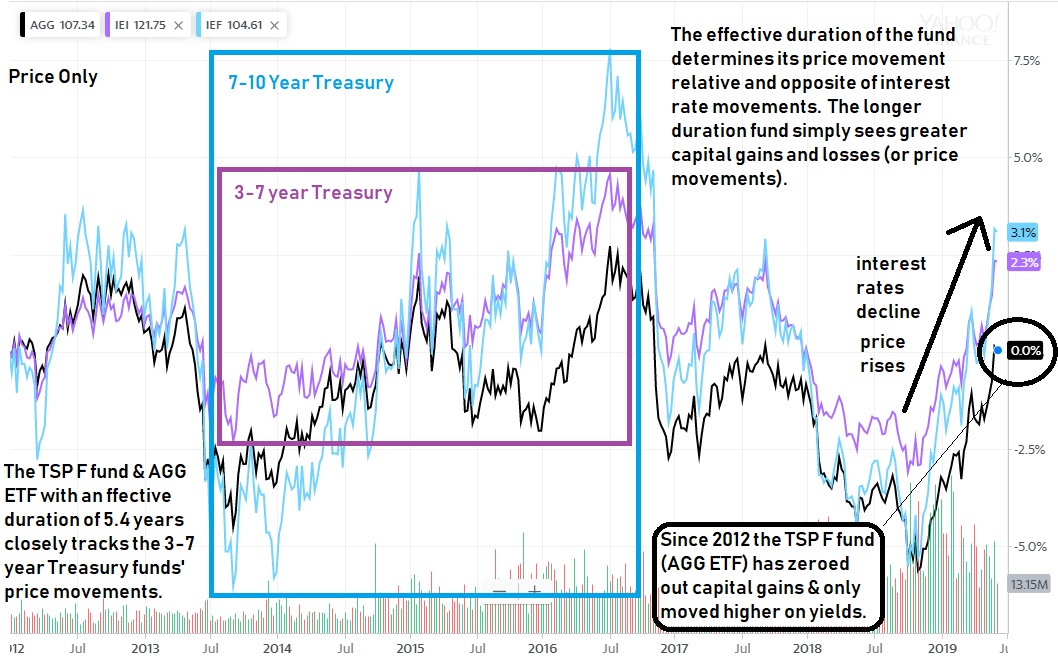

Looking at long term chart of the TSP F fund plotted in black and two Treasury funds. We again note the 3-7 year duration Treasury fund (purple) tracks pretty closely with the F fund. The longer duration 7 -10 year Treasury (blue) sees larger price movements as interest rates move up and down. The longer the effective duration of a bond fund, the larger the price movement of the fund when interest rates climb and fall.

Note this chart starts in 2012 and ends in June 2019, the TSP F Fund (price only) had gained 0% in 7 1/2 years after a series of ups and downs. This means all the gains during this time came from its yield which today is sitting in the mid-2% range. Near term, the F fund price has rallied over 5% from its 2018 low.

Comparing the TSP F and G fund

The simplest explanation I can give is that the TSP F fund provides a small advantage only while interest rates are dropping. Otherwise in a stable interest rate environment, the F and G fund earn about the same yield/interest rate and the G fund comes with lower risk. If interest rates rise, then the TSP F fund sustains a small capital loss which offsets its yield (For example, a half a percent rise in rates will wipe out a year’s worth of TSP F fund yield due to the capital losses).

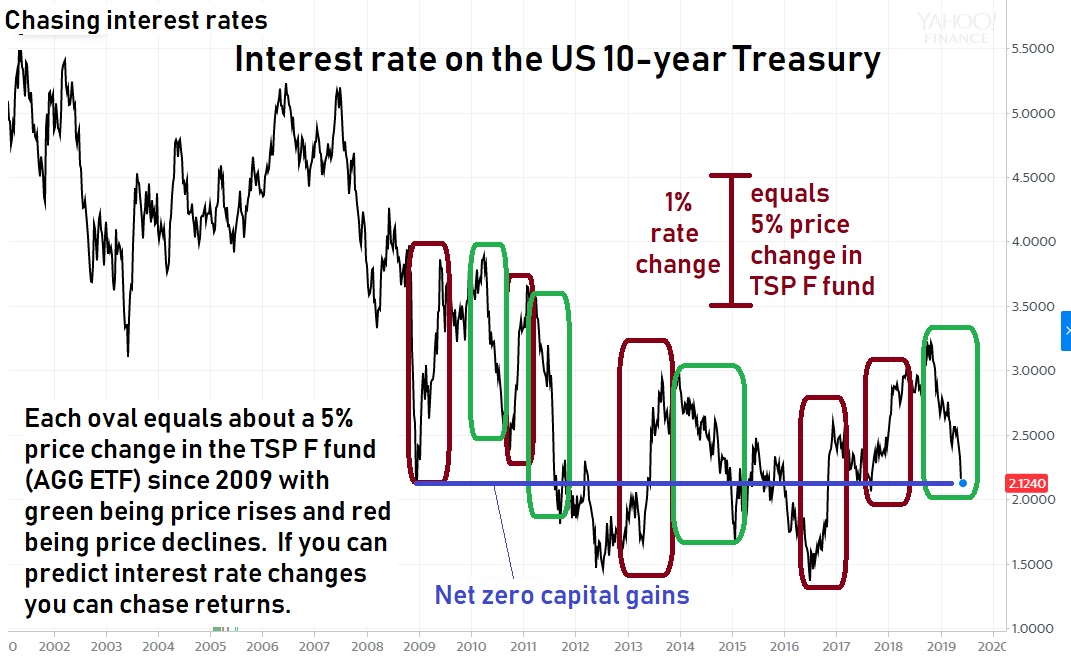

So for most investors today, I recommend the TSP G fund allocation if you want to set and forget. But for traders, the TSP F fund provides some potential. In the following chart we can see that + 5% returns are common. Since late 2011 and 2012 price action is back to where it started in 2009 thanks to the ups and downs of interest rates. Often the TSP F fund sees a bump when the stock market sustains a large drop. If one correctly exits equity funds expecting a correction, the TSP F fund would be a good short term allocation. The caveat is in a major flight-to-safety event discussed later.

What is missing from this chart is the performance of the equity funds (stocks). Simply put investors may be unwilling to sit out of the stock market every time bond funds rally. So the main purpose of this chart is to give some perspective on the capital gains and losses of the TSP F fund over the years. Again, this chart does not include gains from yield.

One of the points I like to hammer home is that unless interest rates are dropping you should be sitting in the TSP G fund when out of equity funds. Of course the magic ball for interest rate futures is always cloudy, but you may be able to capture some of the movements if you do your homework.

Why sit in the G fund when you are not trading?

Because it is no-risk. (I am leaving out inflation risk because it affects all investments)

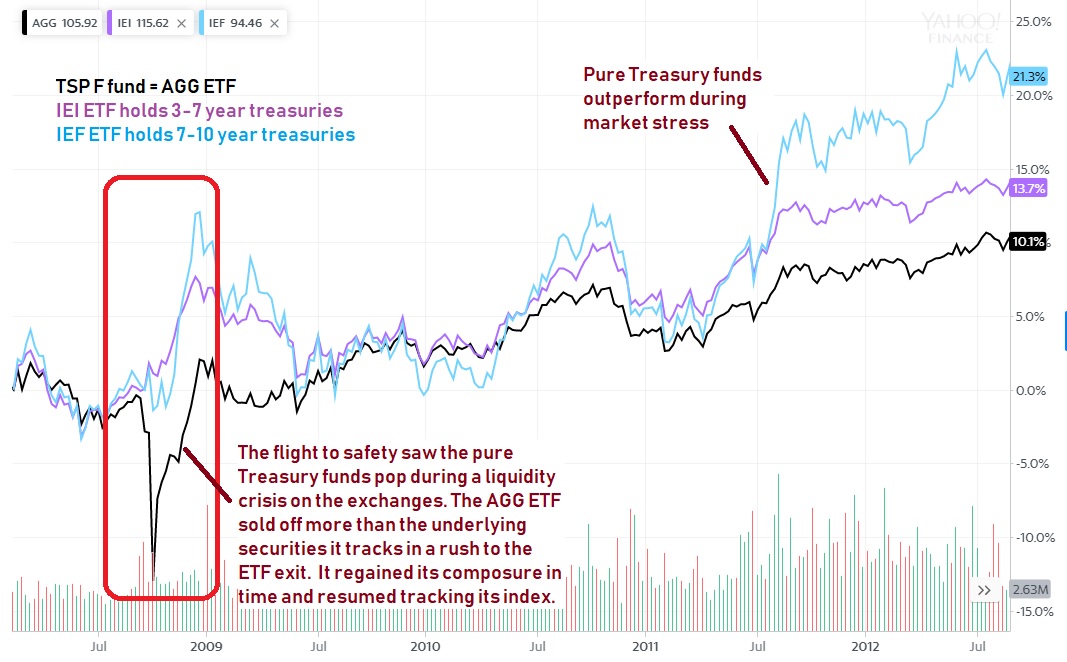

The F fund is low risk, but since it holds some corporate investment grade bonds it has some default risk potential. In a flight-to-safety event, the corporate bond prices will fall while the safe haven Treasuries in the TSP F fund will climb negating some of the benefits of falling interest rates. This is due to default concerns and investors demanding a higher interest rate on riskier corporate bonds.

In other words, even in a falling interest rate environment the TSP F fund can lose out to other pure Treasury funds or the TSP G fund because of a flight-to-safety risk during financial stress. For the AGG ETF, you also have a short-term liquidity risk if all ETF investors head to the exits at the same time. The ETF can fall well below the index it is tracking in the short term. We see this effect in the chart below in 2008.

For the bigger picture on all the TSP Funds, please see

1000 PE

1100 Math

1200 ELA

1300 Science

1400 Electives