-

-

III. Best TSP Allocation

-

-

-

-

-

Best TSP Allocation

TSP Allocation Tips

I use all available tools in our investor toolbox to make allocation decisions.

We have our own trading day seasonal almanac that tells us what calendar influences are driving the markets. We follow the key technical analysis trends and momentum, as well as watch the market internals. We found some leading stock market indicators in the credit markets for warning of coming losses. And we understand that fundamental valuations tell us how much risk of losses is in Market Risk. But unlike many advisors, I focus much of my attention in Meta analysis of the Macro writers - the big picture.

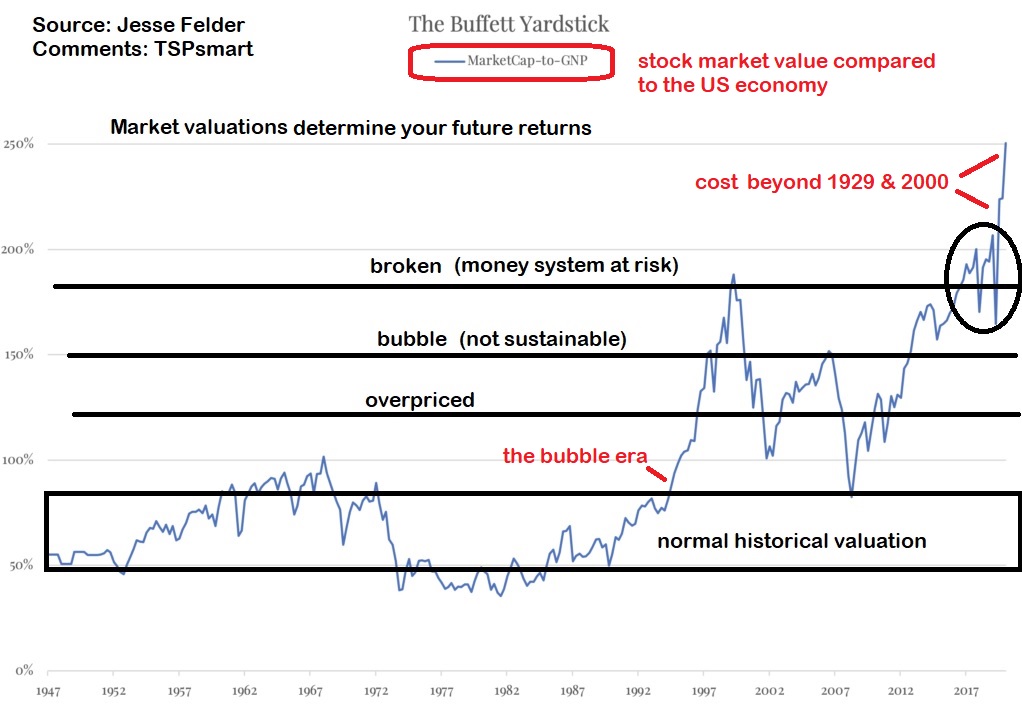

My number one tip is that avoiding gut wrenching losses is more important than trying to catch the top or bottom of the major market cycles. Losing 60% which is now feasible in the SP500 at these price levels will require a 150% gain to break even. Remember, the Nasdaq Tech stocks lost 80% after 2000 and the Nikkei 225 still has not returned to its 1989 level. Also consider, the largest surges in the stock market have come in the terminal phase of bubble markets. It draws average investors in at the worst time.

Note: I have introduced a new signal since the Federal Reserve interventions have placed us in new territory in terms of policy, and market valuations. The new signal is based on the actions of informed risk-sensitive investors in the credit markets. It has a great track record for telling us if a pullback will become a full correction or bear market.

More on investment philosophy...

When should I move TSP to the safety is the most important allocation question?

Successful long-term investing requires knowing when you are close to a market top, understanding what actions to expect from policy makers, what the news narratives look like, and investor sentiment (euphoria). There is a reason it is a "top" and it is not because everyone knows it is a top. We've seen the market drop over 50% twice since 2000. This is not something new to this millennium. Bull and bear markets are part of the game.

From this very simple valuation ratio (Price of SP500 to Revenue) I can guarantee you we are nowhere near the bottom and starting another bull market. The only other time valuations hit this level was in 1929 and the ultimate loss was on the order of 80% during the depression. It is also important to note, you can not time the market with valuations otherwise you would miss some of the largest gains that occur near the top. This makes investing at times like these challenging.

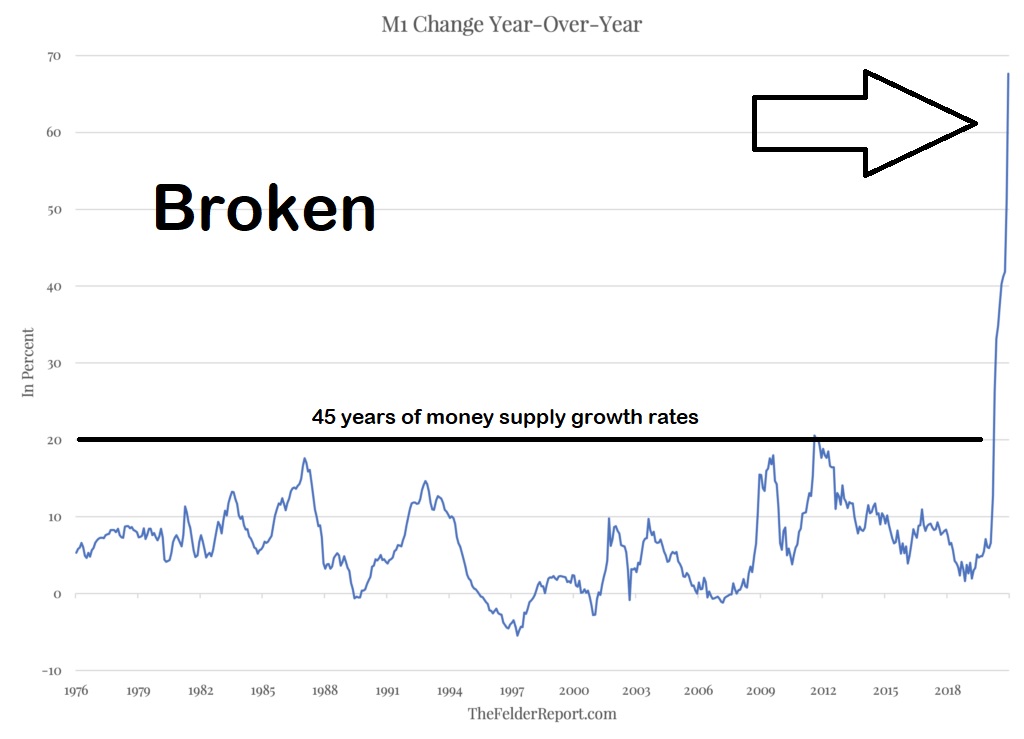

Our money system is taking the hit this time as the Federal Reserve papered over the damage in March that led to the epic rally in the stock market. So if you wondered why the stock market could soar during a deep economic contraction look no further that the flood of money created to prop up the financial markets but not the economy. This is unsustainable.

What most analyst do not discuss is that in the long run what your investments return to you is the cash flow of the companies you invest in. Everyone is focused on the price going up and this only benefits you if you sell near the top. If market prices keep going up but the corporate cash flow from operations does not keep up, your *future* returns goes down. Never in history has the market traded sideways waiting 12 years or more for profits to catch up with price. Never.

With that said, it is better to give up some gains near the top than to ride the bear market down to a 50% loss or more. After a 50% loss, it takes a 100% gain to get back to break even. We have seen two bear markets losing over 50% since 2000 so we know they have not been outlawed.

Market cycles the last 30 years have lasted 8 - 12 years. Prior to the 1990s they ran 3 - 6 years and were often based on fiscal policy gunning the economy for re-election bids. In 2020 we hit the longest bull market in history that started in 2008. The rapid 33% decline was NOT a bear market, it merely returned to the valuations from extreme to bubble valuations. Monetary policy flooded the markets and small caps are more sensitive to liquidity (money flows) and screamed higher.

The reason for historical records in valuations is because the driver of this market is different from all others - emergency monetary policy that never got turned off after the last crisis. We are on a monetary cycle now with some fiscal overlays. But the laws of financial physics have not been eliminated.

Current or future corporate profits & cash flow do not match the prices being paid today for stocks and bonds and a major reset in prices needs to happen (bear market). Again, wealth is a stream of future income not a balance on your TSP account. The same is true for valuations. If you are okay with extremely low future returns then the stock market was fairly valued last year.

As of September 2021, annualized returns over the next 10 years will be negative meaning the stock market will be lower in price in 10 years than today especially adjusted for inflation.

If you expect 8% returns from the stock market then today's market is extremely overvalued. If the market is allowed to go through a cleansing bear market, you will get that 8% return from a much lower price level.

Considerations:

The difference between the TSP C and S fund is negligible compared the TSP G fund during bear markets or steep declines. I am not talking about market timing, I am talking about the market cycle.

At the beginning of 2020 (pre-virus), over 40% of the Russell 2000 index (smallest half of the US stock market) had negative earnings. When the index and funds provide the Price-to-Earnings they conveniently calculate the PEs ratios leaving out the negative earnings. In other words, valuation measures commonly viewed by retail investors significantly understate the valuation levels of the market.

As for the SP500 today, over half of the companies' debt is ranked one notch above junk bond status. Forty percent of these companies are getting a pass from the ratings agencies since their level of debt already exceeds the threshold for junk status.

I expect the market to give back much of the gains once the Federal Reserve drains the excess liquidity out of the financial system.

We give market alerts for deep market corrections and have nailed them for the last several years.

Conservative investors need to be very light on equity funds today and follow along with our commentary. Speculators need to not be all-in should be aware of our alerts.

Buy & Hope

I get the same messages you do from "investment advisers" about "don't panic" and "buy and hold is the best strategy"...

...after the market plunges.

As you see, I have a different point-of-view on this subject. I started my service in 2011 because I felt no one was looking out for the average TSP investor.

What the buy and hold types fail to mention is that it took 13 years for the market to break even after the 2000 market top. They also fail to mention that Japan's market topped in 1989 and they are still waiting for a new high 34 years later!

A Note About Investing in Retirement

When most investors retire, allocations need to shift to low-risk funds for income production.

For this reason above all others, please do not leave TSP when you retire! I am probably one of the few advisers who recommends considering moving your other retirement account funds to TSP to take advantage of the G fund in retirement (along with the low fees). Yes you can do this.

Can you imagine your broker or bank telling you to pull money out of their account and send it to your TSP account where they lose fees. Commission-based financial planners are likely to talk you into moving your funds to their accounts and products so they can manage them for you to make your life easier. It is not just the advisers fee that will cost you, it is the loss of interest income in retirement by not having access to the TSP G fund when you need to be in low-risk investments.

Please don't move your funds. You can do fine managing your own account. If you transfer your funds out of TSP, consider keeping $200 in your account to keep your account open to allow you to change your mind later.

The Reluctant Investor and Staying Invested

In my conversations I have found many investors who were burned badly during the last two bear markets and remained reluctant to re-invest until very late in the bull market. This is very understandable but also leads to frustration in extended bull markets like the one we've been in.

Investment decisions require knowing both when to get in and when to get out. I am not talking about cherry-picking the top or bottom, but simply being close.

Market tops always happen when the news is most positive and bottoms happen when the end of the world is around the corner. So do not let headlines determine your allocations.

Remember not everyone can get out at the top. Tops form when the smart investors start heading to the exits before the masses do. And this happens when the headlines are most positive.

We reduced exposure near the top in the early 2018 parabolic move, but the market was not indicating a bear market at that time. We are watching our long term signals that lead the stock market and provide insight if a move is a correction or something more. We are also watching the long term trend of the market as seen on the chart below in blue lines?

I hope you bookmark our free blog or sign up for our blog posts via e-mail at our blog's website. I hope you become a TSP Smart Investor. If you want to receive our e-mail warnings like the one represented by the red arrow we sent to members to reduce allocations to equities, please join us.

We don't spam, here are a few of our warnings in a chart. We are not a market chasing timing service. We are a bear-market-avoiding service along with providing a simple-to-execute seasonal strategy that has beaten buy & hold annualized by several percentage for the last 60 years. I haven't talked about this strategy, but I provide links at the bottom of the page.

Members have access to current charts and market warnings

Don't Go It Alone

I monitor the market for serious and reluctant investors so they can spend their time doing what they really enjoy in life and that is usually not watching the financial markets. And remember, long before there was fake news, there was financial news.

I provide two primary services with our low-cost basic service that keeps we watching the markets full-time for you:

1) Bear market and large correction warnings

2) An easy-to-execute strategy from my best practices research to avoid losses while capturing most of the market gains.

And serious investors should take a look at our TSP trading day almanacs to add to their investor tool kit.

Don't forget to follow our free blog directly or via Facebook

Blatant Advertising Get our Market Warnings and Commentary Our basic rate is only $85 annually which is less than 1% of $10,000 account. Compare this to the last two bear market which cost the stock market over 50%.

A quick note about me After earning my degree in Investment Finance, I joined the US Air Force and thus became a TSP account holder. I never gave up interest in finance and continued to study the markets while serving. I discovered I had to do some unlearning from what I "learned" in my financial planning courses. Through my website and blog I share what I've learned. I spent years researching the best strategy for the TSP funds. I wanted a strategy that was easy to execute and did not ride the bear markets down. I almost gave up then found Sy Harding's strategy which only required two trades a year and was rare in that it beat buy and hold over the long haul. Mark Hulbert of the Financial Digest fame tracked Sy's record and often wrote about him on Market Watch. Sy invested in the Dow Jones Industrial Averages. I simply optimized Sy's seasonal strategy to fit our TSP funds. I also developed my own TSP almanacs which break down the annual patterns of the markets to the trading day of the year. On my website you will find a more in-depth breakdown than the Thrift Savings Plan's own website for each fund (to include the Lifecycle funds) to better understand what is driving their returns. It all helps in determining the best TSP allocation. I started my company in 2011 and my service in 2012. I hope you have some time to look around the site - it is designed for you. And did I mention you can also sign up for my free blog. or just join us Testimonials

Mr. Bond,

|

|