-

-

-

-

-

-

Confidence Surveys and Future Returns

-

-

-

Independent allocation advice grounded in history not hype  |

Confidence Surveys and Future Returns

the Wall Street Journal 10 September 2018

Economic Confidence Is Really High. Perhaps It’s Time to Sell.

Rather than look to the future, investors tend to extrapolate the recent past, and mostly get it wrong

Rarely have gauges of the American economy been stronger. It’s time for investors to worry.

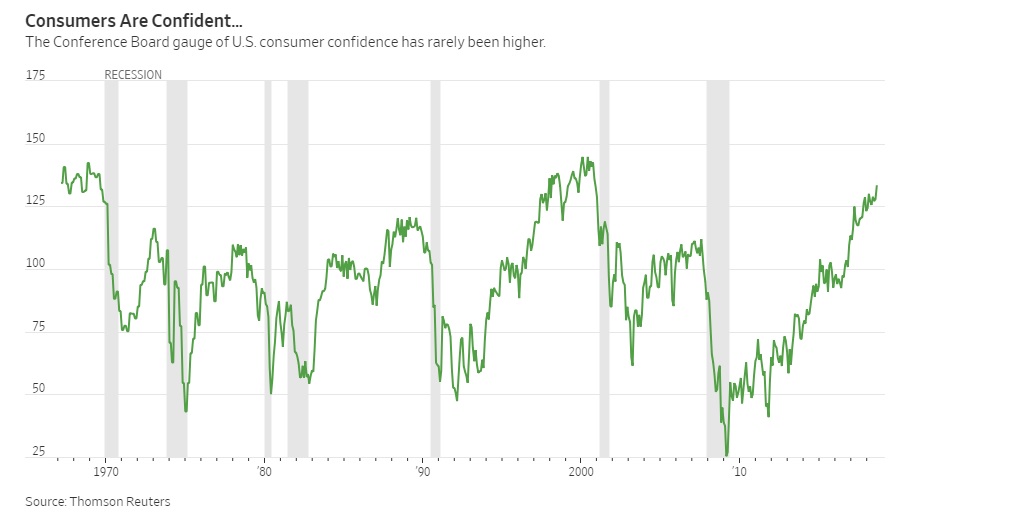

Last week brought yet more strong figures from the U.S. economy, with another surprisingly strong jobs number, wages rising the fastest since the last recession ended and the ISM survey of manufacturing the best since 2004. The previous week brought consumer confidence measures at their highest since 2000, according to the Conference Board. What’s not to like?

For investors, a lot. The problem is well-studied and should be obvious, yet continues to be ignored: When the economy is strong, stocks soar as confident investors bet that the good times will keep on rolling. When the economy struggles, investors assume it will never recover. Rather than look to the future, investors tend to extrapolate the recent past, and mostly get it wrong.

This shows up most obviously by looking at how closely stocks move with gauges of consumer sentiment or the economy. Since 1974 there’s been a 48% positive correlation between the change in the Conference Board consumer confidence index and stock prices over the previous 12 months, meaning stocks have a fairly strong tendency to rise when consumers feel more positive. This should surprise nobody. Yet those who buy because of past changes will find a slight negative correlation between consumer confidence and returns over the next year—because confidence typically doesn’t keep on improving (or worsening).

There’s an even more powerful effect with ISM manufacturing, frequently used as an indicator of the broader health of the U.S. economy. The 12-month change in ISM had a 44% correlation with the change in stock prices since 1974, again something which should elicit a big yawn, because we all know that when the economy gets better, stock prices rise. But the future returns have a tendency—a notable but weak negative 20% correlation—to move in the opposite direction. Again, it suggests investors assume that recent economic trends will continue, and are wrong-footed when they don’t.

The exact same effects apply to the overall economy, too. Armed with perfect hindsight, GDP is one of the best investment tools there is, as a better economy means higher share prices, and vice versa.

But if you buy because of what the economy did over the past year or the past quarter, you’re making a big mistake. There’s essentially no link between what U.S. GDP did, and what stocks do over the next quarter or the next year, because what matters is what the economy will do in future. If you think you know that, great, but your crystal-ball-gazing skills might not be quite so good as you imagine. Plenty of smart people are trying to predict the economy, and their record of getting it wrong is superb.

Academics Elroy Dimson, Paul Marsh and Mike Staunton in 2010 demonstrated that the same is true in lots of countries. They found no link between the latest report on the economy and future returns, but a strong link between the—unknown—future state of the economy and future returns.

Even worse is that so many gauges are close to extremes. Buying stocks when confidence or growth is extremely high or selling when they are extremely low works even less well, because from extremes both tend to snap back a lot further. The current levels are truly extreme, with consumers more buoyant only during the excesses of the late 1960s and the late 1990s. Both times ended badly for shareholders when bubbles popped.

The hope for investors is that this time round a bubble might inflate too. Households aren’t holding nearly as much debt as they were in the last economic cycle. If American consumers start to borrow to fund a spending splurge, stocks could rise a lot further—even if it would ultimately end badly.

History provides the weakest of justifications for hope. Going back to the 1960s, on average stocks rose in the 12 months after consumer confidence came in very high, above 120 on the Conference Board index. But they only rose 3% on average, compared with the handy 14% average made by time-travellers—or perfect forecasters—who bought 12 months before confidence rose to such levels. It was better to hold bonds than shares at such high levels, too, giving a better return and less volatility. Still, at least shareholders who were late the party didn’t lose money, so long as they sold promptly once confidence began to fall.