-

-

TSP Lifecycle Funds

-

-

-

-

-

What are TSP Lifecycle Funds

TSP Lifecycle Funds

What are Lifecycle Funds?

Lifecycle funds are designed for investors to simply select the Lifecycle fund that corresponds to their retirement date (such as 2040 or 2050). The Lifecycle funds adjust allocations internally so you don't have to. While this is simple, we will discuss whether it is a good idea. The Lifecycle fund investments are "professionally" determined based on mainstream thinking on how investors should be diversified to reduce risk as you grow older. The allocation mix is adjusted to be more "conservative" as one nears retirement and then moved into a very low risk (and return) income producing fund in retirement.

Lifecycle funds diversify their equity allocations based on market weightings. This means that the SP500 index which holds 80% of US listed market value compared to the small cap funds 20% gets 4x the weighting of small caps thus creating a diversified total US allocation. It also adds in to the mix the international fund based on its market value so that you in effect receive a total developed world diversification. If emerging markets are added to the International fund they will be factored in based on their market values and this means the US weighting will go down a bit. The take away is the portion allocated to equities gives you are geographically diversified holding of the developed world's stocks based on market values. I do not see this as a positive diversification which I talk about later.

The Lifecycle Fund Strategy

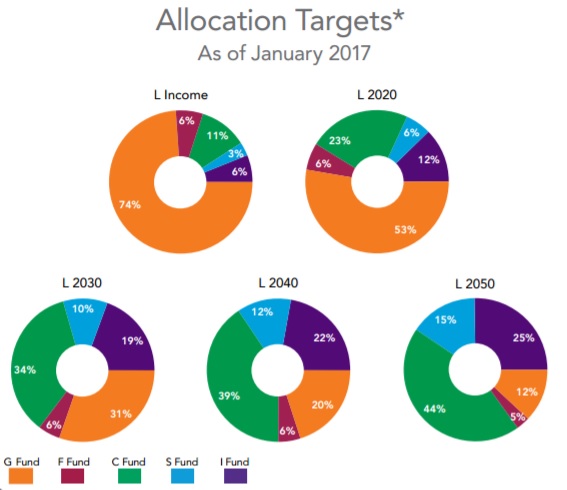

The investment strategy assumes that the greater number of years you have until retirement, the more willing and able you are to tolerate "risk" which portfolio managers define as merely fluctuation in your account in order to "pursue" higher returns. The idea is that for a "given risk level" and time horizon (your retirement) there is an optimal mix of investing in stocks and bonds to provide the highest "expected" return. The next graph comes from the TSP Factsheet on Lifecycle funds. Here we see how allocations differ based on your target retirement date (plus or minus 5 years).

The government's TSP Lifecycle funds invest in a mix of the five basic TSP funds (as seen in the chart above) based on your years to retirement. The Vanguard Lifecycle Mutual Funds add international bonds and other instruments, but lacks the TSP G fund so Vanguard investors have to assume more risk in retirement. The Lifecycle funds come with all the risks associated with the basic mix of funds they invest in.

The Stated Risk

The primary risk for any equity (stock) fund is market risk or the fact that the stock market can lose a significant amount of your funds in a very short period of time. Portfolio managers often recommend setting a mix of stocks to bonds such as 70/30 when younger and moving to 20/80 in retirement.

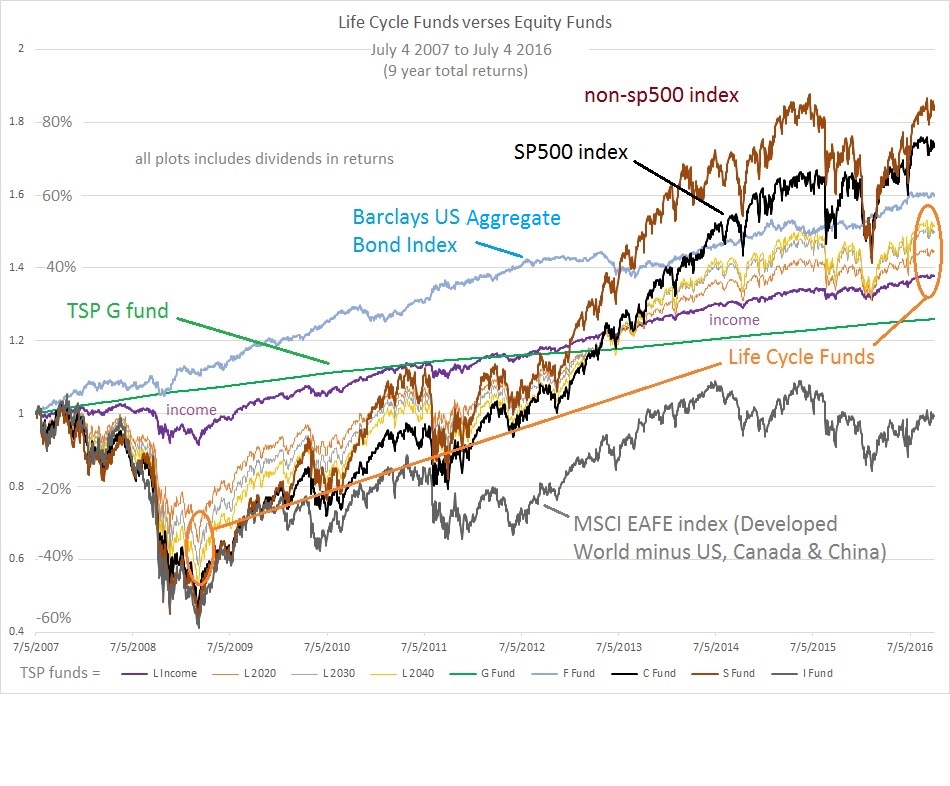

Since bonds are less volatile than stocks this simply reduces the "fluctuation" of your overall investments which is their definition of "risk". As highlighted by the orange ovals in the next chart, we see what this really means is your account loses less in a down market but gains less in an up market. Whether you beat the basic funds depends simply on what time period you refer to.

A close examination of the lifecycle fund performance as highlighted by the ovals in the next chart shows they lose less in bear markets but also gain less in bull markets. The end result is over the long term you receive a weighted average return of the basic funds. The shift to lower allocations in equities (stocks) merely reduces your risk of sustaining larger losses closer to or during retirement. The assumption in academic portfolio management that the level of risk in the market for large losses can not be determined makes marketing and management easier for companies with large numbers of clients. Imagine if one large brokerage sends a message out to all their clients telling them to sell at the same time - it does not happen. Buy and holding is not how insiders and smart investors manage their portfolios.

The Real Risk

It is important for investors to understand that the Lifecycle fund's primary strategy is buy and hold no matter where we are in the stock market cycle. The unwritten assumption of these funds is that market risk and "expected" future returns are static - which is far from reality. The true risk of investing in any fund is the risk of significant losses and this risk changes over time.

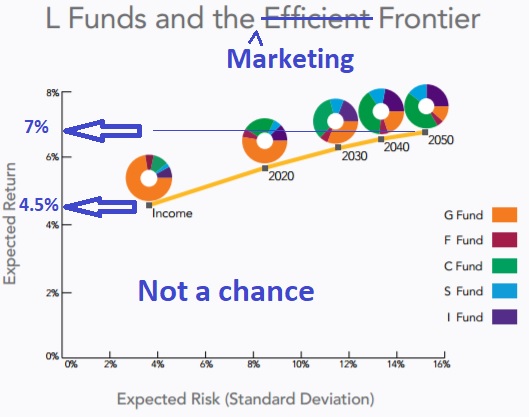

The next graph comes from the TSP Fact Sheet on Lifecycle funds with my markups in blue. If you compare the actual price movements in the chart above with the "expected" future returns in the chart below, you see that future returns really depend on where you are in the stock market cycle. At the time this graph was created the marketed return of the L2050 fund was 7% and the Income fund was 4.5%. With interest rates sitting close to 2% today, there is no way the Income fund will earn 4.5% going forward. The 7% return is based on history but at current market valuations this is an impossible return for 30 years without purchasing power destroying inflation kick in.

My point here is that the buy and hold and ignore valuations feature of the Lifecycle funds will not be kind to those funds holding large allocations to equities at some point in the future. If market valuations return to normal levels, then these funds become more intriguing.

In the last 20 years, the popular SP500 index fund that holds about 80% of the value of the entire US stock market lost over 50% twice. While marketing data points to many years of great returns, what is missing from this data is the fact that it takes 100% of gains to simply break even after a 50% loss on your portfolio.

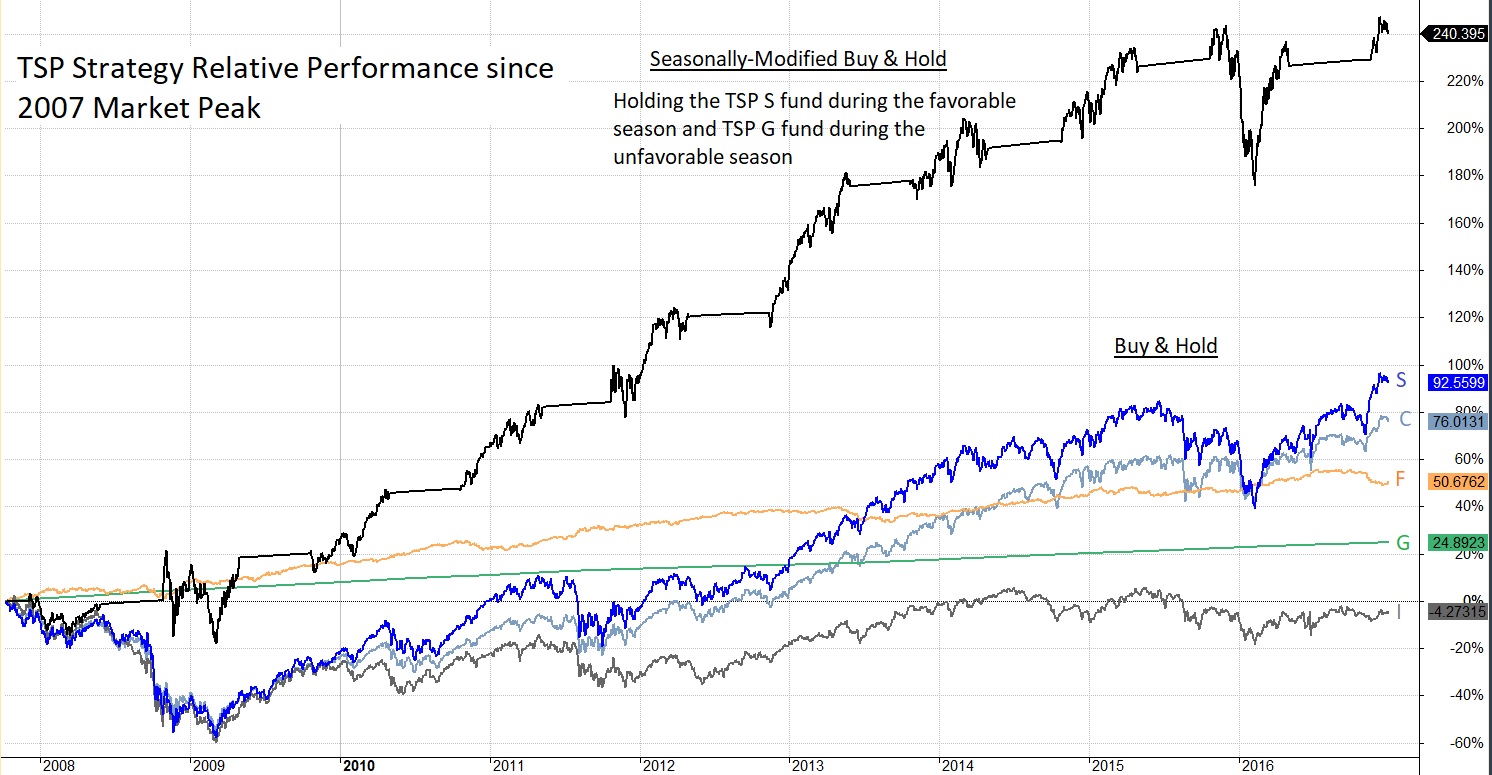

In the price chart above we see it took all the Lifecycle funds as well as all the equity index funds over five years to catch up with the lowly TSP G fund after each decline. The largest allocation TSP gives to the F fund in Lifecycle funds is only 7% for all age groups!

Like most funds, TSP gives lip service to the fact the future "may" not look like the "past" - it won't. The following paraph is found in the TSP factsheet on the Lifecycle fund...

As you move out to the farther retirement dates, one could argue that the market cycle matters less and thus using the past average returns to market the expected future returns is justifiable. With 85% of the 2050 fund invested in stocks, using an 8% average gain on the stock market looking back leads you to an expected return of 7% in the chart above.

But even with this long time horizon, it is hard to justify a buy & hold strategy when the stock market is flirting with the same high market valuation levels relative to sales, dividends and many other factors as seen in 1929 or the stock market bubble of 2000. In other words, it is highly probable the stock market will be no higher in 12 years as it is today with much better buying opportunities during the next decade.

Another assumption presented as fact in most marketing material is that investors have to assume more "risk" in order to "pursue" higher returns. I disagree with this concept thoroughly and as we see with the Lifecycle funds the changing mix of investments between stocks and bonds merely reduces the fluctuation in the fund to both the upside and downside. While the safer funds (with more bonds) take just as long to get back to even.

Investors should reduce exposure to stocks as they approach retirement. This is a sound principle but the Lifecycle funds even fail this principle in the last 10 years prior to retirement as highlighted in the "Details" section below.

But more important is the failure of the Lifecycle funds to reduce exposure to equities when the stock market risk is most elevated. This is different from market timing or moving into and out of stocks based on a 1000 great ideas. It is simply sound investing and does not require many allocation changes.

If you entered this page from our I. Best TSP Allocation, I recommend you move on to II. Best TSP Fund to continue. If you have not read the part one, it does explain why I don't think adding in the TSP International fund helps the Lifecycle funds from several perspectives. This may change in the future, but not for some time.

The details of Lifecycle Funds and how you can beat them with lower risk

Both the Vanguard and TSP Lifecycle fund investment allocations were set by professional investment analyst who are investing for the typical investor. So what better baseline data to start with for your own allocation percentage decisions. We will be discussing the limitations of these funds - basically they are buy and hold funds that do not avoid market risk in general, just diversify it.

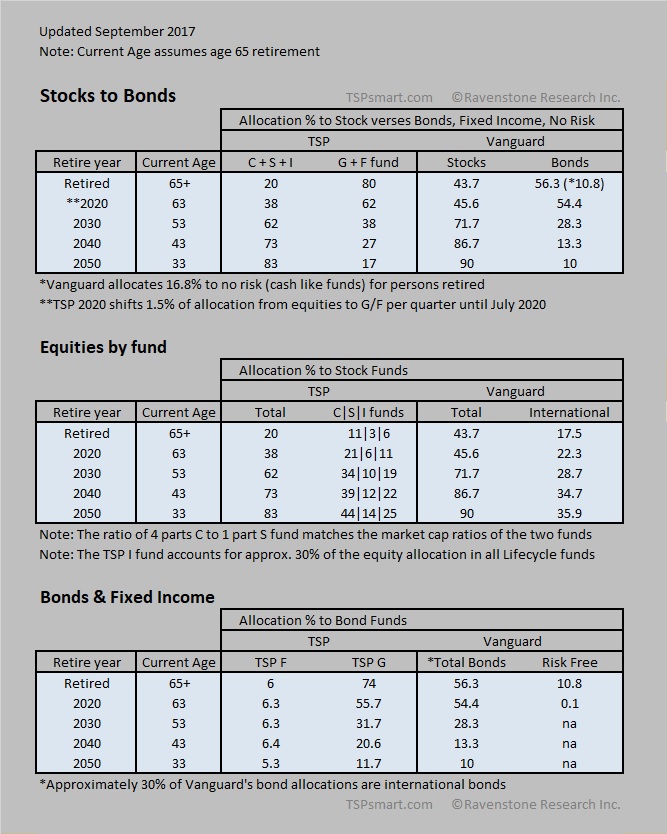

In the table below, I took a snapshot in time of their recommended allocation levels based on when you expect to retire. I assume they consider 65 the retirement age and plugged that into the table. The basic stocks allocation verses bonds percentages are in the same ballpark for TSP and Vanguard. As expected, as you move closer to retirement the recommendation from both is to reduce exposure to equities (stocks).

Before delving into the table, I want to make clear that I do not like lifecycle funds and I only present the data so you can obtain a rough guide as to what your baseline allocation to equities should be based on your age. I do not like lifecycle funds for the same reason I do not like the buy & hold mantra of wall street. Buy & hold investors take significant losses that take years to get back to where their balance sheet started. I do not espouse speculation and trading, but I strongly believe there are times when market risk (risk of significant losses) is elevated and you should not be in the market, period. Eight years of bull market gains can evaporate in a very short period of time.

Okay, lets jump to the table. The "stocks/bonds" section provides a general look at the allocation split between stocks and bonds. Vanguard does not have the advantage of investing in the G fund which provides a risk free return based on short term US gov't bonds. The only risk free allocation Vanguard shows in their funds occurs in their "retired" fund in with a 10.8% allocation. Otherwise they invest in bonds, shifting to safer short term bonds as one closes in on retirement. Vanguard does invest in International bonds where TSP does not have that option, but I do not think it provides much in terms of diversifying risk.

What surprised me initially was that TSP remains at approximately 6% in the F fund regardless of age thereby shifting funds from equity to the G fund as one closes in on retirement. Presently both funds are providing the same yield, but the G fund comes with much lower risk. Frankly, I can see them moving to no allocations to the F fund in the near future if interest rates start rising.

Even in retirement, both TSP and Vanguard recommend holding some equity. Both funds show a significant drop off in recommended equity allocations from 15 years prior to retirement compared to "in retirement". If you lose a significant amount of your retirement funds in those last 5 years, you can not make it back. Maybe they assume you could delay retirement if you lose money while working, but after you retire you probably are not going to get that job back.

Vanguard appears to have shifted to holding too much exposure to equities in retirement (44%) compared to TSP's 20% for buy and hold investors.

Why the last ten years matters? The market cycles in bull and bear markets in less than 10 years. If the market tanks when you have 9 years to go to retirement, there will probably be another bull market to regain some of your losses. If it tanks with 2 years to retirement, you will take the hit but miss any bounce back during the follow-on bull market. One major assumption is that the market always bounces back and this may be tested during after the next bear market. Of course, the better solution is we need to avoid those bear market losses and significant corrections all together.

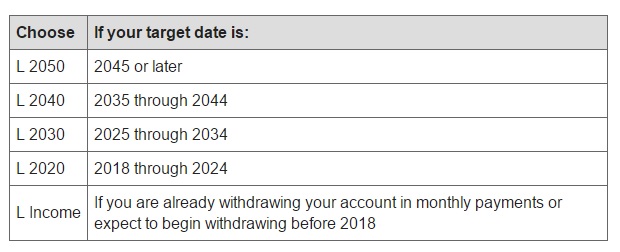

Another target date issue occurs close to retirement dates that per TSP guidance as seen below. If you are retiring in 2018 and you use the 2020 fund you would be holding a higher exposure to equities your retirement year than someone retiring in 2024. There is a bit of allocation averaging here that would not be helpful in a bear market for some investors.

How can you can use this information as a guide to develop your baseline allocations in stock funds (TSP C/F/I funds)?

If you are going to retire in 2030, you can see TSP is holding a 65% allocation to equity funds and Vanguard is holding 75%. Since stocks tend to gain and lose more than bonds, this is the most important takeaway from the chart. The decision between the fixed income funds (TSP F fund) and no-risk funds (TSP G fund) will have a much less impact on your returns than what happens in the stock market.

I'm also less concerned about international exposure. The S&P 500 index (TSP C fund) has significant exposure overseas and if the US economy and markets tank, the rest of the world will too. The MSCI EAFE index fund (TSP I Fund) invests in 85% of the developed world's listed companies (does not include US, Canada and China). The SP500 index receives over 30% of its revenues from international sales and I think that is enough exposure.

But I also have an issue with the international index (TSP I fund) - it is highly exposed to financials and has little technology exposure. All the global large tech firms are US companies or listed in the US. In today's world, the financial industry is at great risk (low interest rates & bad practices). Profit growth has been in technology and online retail and the SP500 captures this with Apple, Google, Amazon, Netflix, Facebook, etc.

Don't think in terms of international diversification with a fund, think of the US dominance in technology profits sitting in the SP500. Instead of diversifying with an international fund, I would stay focused on decreasing market risk in the US funds during times of market distress. The US market is also backed up by the world's reserve currency and a central bank that is equally capable as willing to support the financial markets. This is not the case in the rest of the world.

Large Cap funds verses Small Cap funds

The SP500 equals about 80% of the US market cap and the small cap fund (TSP S fund or VXF ETF) equals the other 20%. So this means holding four parts the SP500 fund to one part non-sp500 fund gives you the proper weighting to equal the total US stock market. Looking at the TSP C to S fund ratio, we see the TSP Lifecycle funds give young investors a higher ratio of small caps to the large caps (more risk). As the funds approach retirement they shift close to the 4:1 ratio.

One of the points I want to make here is that merely splitting your equity funds in 33/33/33% would not give you a balanced portfolio in terms of market capitalization, international exposure or high-growth tech exposure.

For those who follow our Seasonally-Modified Buy & Hold strategy... How could you apply this target allocation data based on your age or years to retirement?

First decide your baseline equity allocation which should be somewhere between TSP and Vanguard's and simply allocate this percentage to equities during the favorable season for equities based on our timing signals. By cutting your market risk in half by sitting out the worst part of the year for stocks, one might slightly increase one's exposure to the stock funds while invested during the favorable months for stocks.

As the market valuations become historically elevated and the risk of a bear market or deep corrections are indicated by our cyclical indications, one should reduce allocation levels to stocks below your baseline allocation level even during the favorable season.

Remember we are increasing our long-term returns by reducing market risk, not increasing it or chasing short term returns (3 and 5-year past returns are always highest near a market top).

The chart compares our Seasonally-Modified Buy & Hold strategy switching between the S and G fund each year to passively holding the five TSP funds. The Life cycle funds merely average and diversify the performance of the five funds based on their allocation percentages. The seasonal approach avoids most of the market's corrections leading to higher returns for any of the equity funds. Simply put, a seasonal strategy increases your returns by lowering your market risk - something a passive strategy can not do.

To learn more of how you can reduce risk while increasing your returns read about the best TSP strategy and how it can also be applied to any retirement account.

An investment adviser who asks you what is your desired "level of risk" is no different than a used car salesman asking you what amount of monthly payment you can afford. Neither question is pertinent. You want the highest possible returns with the lowest possible risk. Lifecycle funds with their buy & hold strategy will get you neither.

Invest safe, invest smart.