-

-

TSP Funds to avoid

-

-

-

-

-

TSP Funds to avoid

We should avoid funds that will underperform in the *future* not the past. But many of the reasons the TSP I fund underperformed as still in place. It will have its day again, but not until certain factors change and some of the risk baked into the financial markets is wrung out. This page explains why the TSP I fund has underperformed this entire bull market. TSP I FundInternational fund - currently the developed markets minus the USA

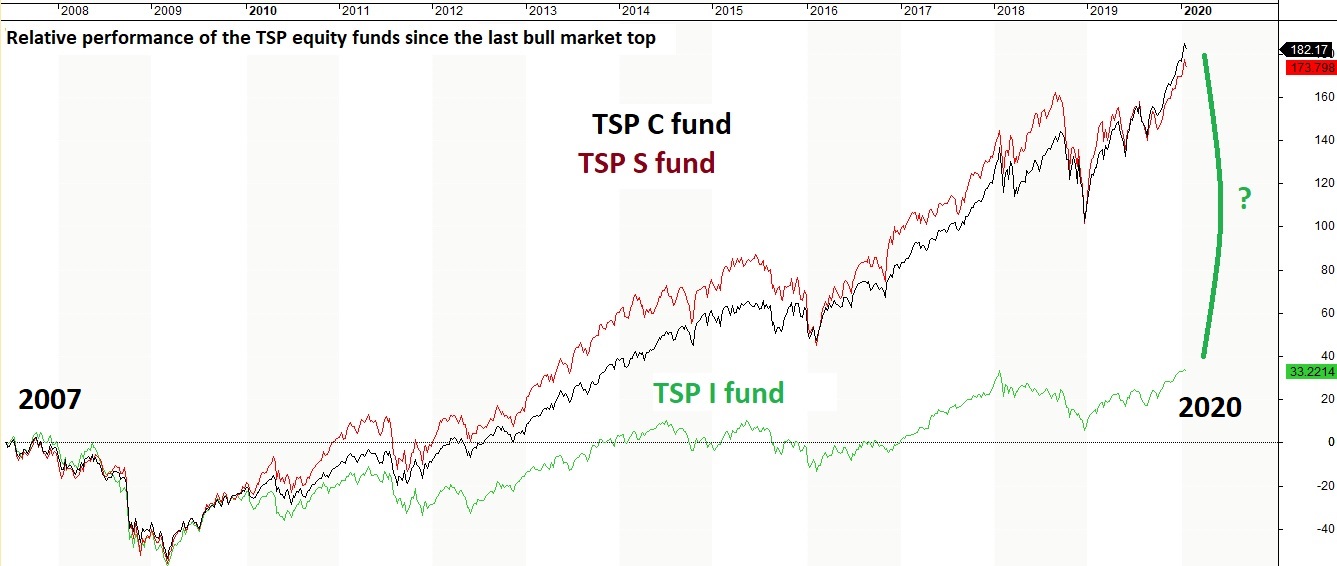

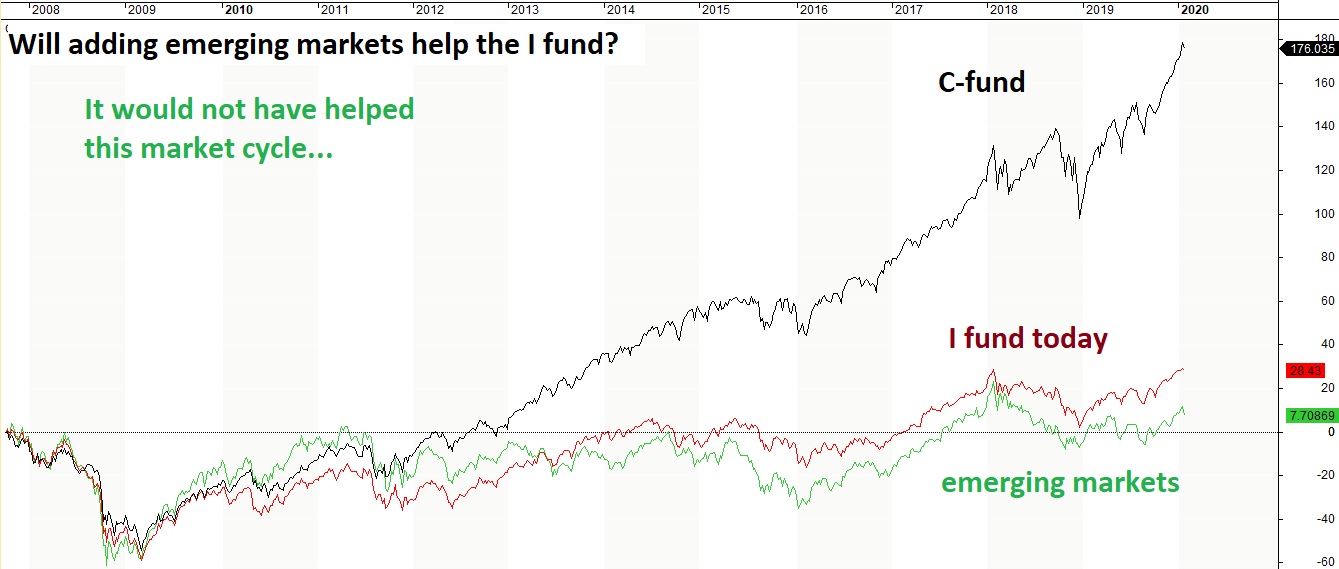

Forget the international fund (TSP I fund) this market cycle... Take a look at the TSP I fund performance since 2012 compared to the TSP C fund (SP500 index). The primary reasons the international fund has under-performed the US funds is 1) lack of exposure to the global tech sector which is the best performing sector and 2) US companies have burned over $5 trillion in cash buying their own stock on the open markets during the bull market - this practice is largely illegal or looked at harshly in other countries. We will also discuss the inclusion of emerging markets. The SP500 companies as a whole obtain 31% of their revenue outside the US, meaning the SP500 is already diversified internationally (including emerging markets). Better yet the SP500 tech sector obtains 59% of its tech revenue outside the US. When you add the I fund to your allocations, you are quickly under-weighting the world's large tech stocks. The International index (TSP I fund) is weighted with only 8% tech compared to the TSP C fund's 20% weighting. Facebook and Google have been moved to the communication services sector and they too sit in the SP500. These companies are predominately tracked in the SP500 index and pulled the TSP C fund well ahead of the TSP I fund. These are the most profitable growth companies in the developed world and again they sit in the TSP C fund. Using their high profits, the tech sector led the way in stock buybacks. This not only helped the tech sector stocks, but pulled the SP500 higher. Many US companies have engaged in this form of financial engineering and unfortunately too often borrowing to buyback their own stocks. The effect on the US stock market has been significant and is one of the two primary reasons the US funds have outperformed this market cycle. Update: The high US corporate debt levels (used to buyback their own stocks) are also the reason why the US stock markets will see a deeper, longer bear market. This does not mean you can diversify into international stocks - the entire world stock market has become highly correlated. High correlation does not provide diversification benefits. If the US makes buybacks illegal again, then I expect the 3 funds returns in the next bull market to be closer and we will take a look again... after the bear market. Post coronavirus the only companies with the cash to perform buybacks are the large tech companies. Apple is leading the way in burning their cash on their own stock and is the only reason they past $2 trillion in market valuation. Their revenue has been flat for years and the geo-political risk to their future is high. TSP I Fund adds emerging marketsUpdate: I would be surprised if they add China to the I fund now, but other emerging markets may still be added. Emerging markets are better valued today along with the rest of the international holdings of the TSP I fund. But the I fund will go into a bear market with the US funds and then they may offer a safer and better entry point if all the policy changes I expect to happen in the US come to be.

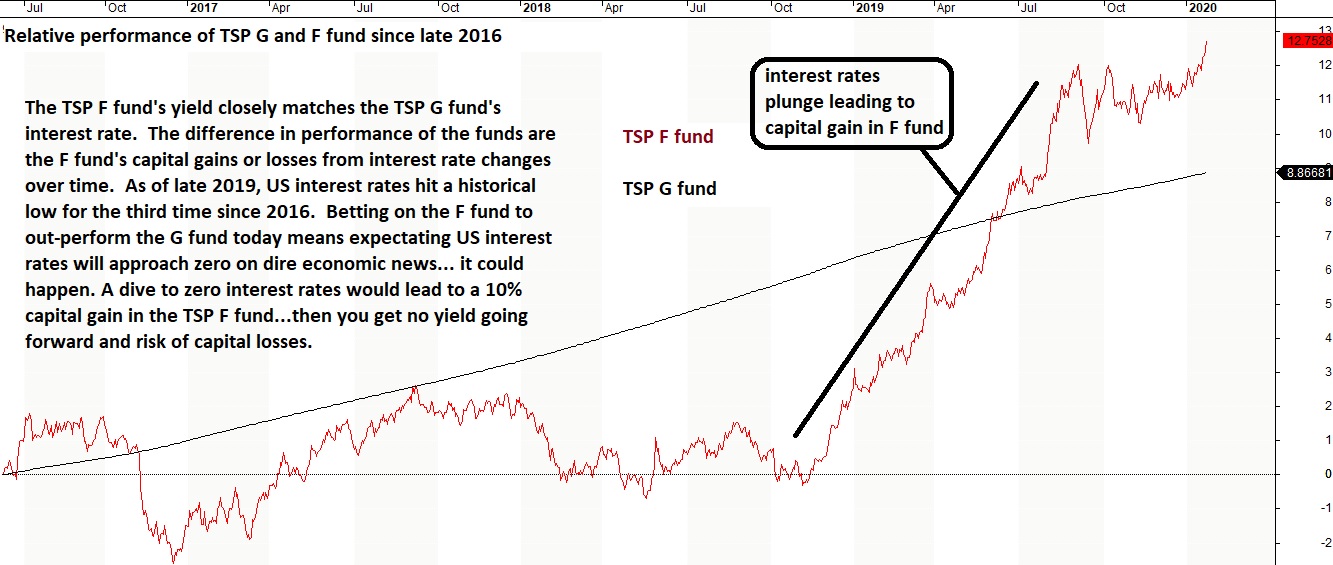

Adding emerging markets does compliment the TSP US equity funds from a geographic diversification point-of-view. But diversification into under-performing sectors is not a benefit and remains the same with the new index it may track. The biggest problem with Chinese companies is the lack of rigorous accounting and oversight in China. Many Chinese companies will not be standing after the next global financial crisis. This has more to do with financial falsifications than a simple recession. Chinese companies are stating cash and other assets they do not have. One of their top auditing agencies has been caught knowingly signing off on fraudulent accounting records. Not to over-state China, its contribution to the I fund would top out around 7-10% in the near term based on 2019 data if allowed entry. The delay in entry has been beneficial in one respect (Sept 2021). China's tech sector is down 70% as China's leadership hammers down on the mega companies. Europe: The TSP I fund is also holding over a 24% weighting in financial stocks and frankly Europe’s banks and finances are a bug looking for a windshield. The European Central Banks manipulation of interest rates into negative territory merely covered up the European problems in the short run with little positive effect on their economy. Europe's financial and political system is in serious trouble - you don't need this risk. While the US stock market is more over-valued today, the global stock markets were highly correlated to the downside during the last two bear markets - meaning you can not hide in international stocks when the US stock market rolls over into a bear market. Adding emerging markets adds an additional risk to the I fund. My concern on emerging markets are the lack of protections for investors in some countries during another financial crisis. I would eliminate the TSP I fund from your allocations this market cycle. Update 2021: This market cycle is coming to an end. Some of the advantages of the US funds will not exist in the next market cycle. I will be relooking the TSP I fund after the markets are allowed to reset. The TSP I fund did NOT go through the valuation expansion the US funds this market cycle. But they will decline in a bear market too. Our seasonal strategy continued to work for the I fund the last 5 years. TSP F fundComparing the two low-risk funds With one exception I consider the TSP F fund the less desirable low-risk fund for long-term investors at this point in history. The exception to this rule is during periods when US interest rates are declining. The difference in performance of these two funds are the capital gains or losses the F fund sustains during the year due to interest rate movements. Unless interest rates are falling, there is no reason to be in the F fund over the G fund since the G fund interest rate closely matches the TSP F fund's yield. This may explain why the TSP Lifecycle Income Fund for retirees has been holding 74% G fund and only 6% F fund. From the F fund’s inception until 2012, interest rates were declining and the F fund’s price went up due to the falling rates. While this makes the F fund’s past performance look good when comparing it to the G fund, this has not always the case. Since 2012 interest rates have put in three bottoms, one in 2012-13, then 2016 and recently in 2019. The TSP F fund price has been on an interest rate roller coaster since 2012 with the only sustained gains coming from its yield. The latest dive in interest rates bounced off the two previous lows and recently hit a new low. .

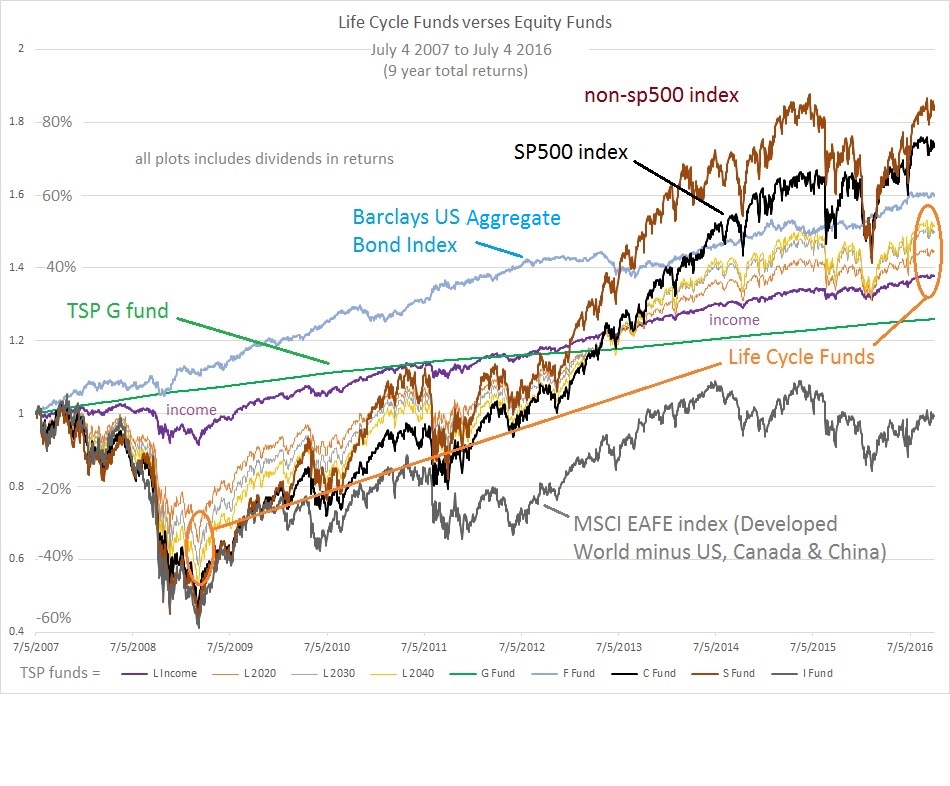

We saw downward pressure on interest rates was due to a slowing global economy and increased financial stress. Holding the TSP F fund is a bet that interest rates in the US will plunge to record lows which implies a negative forward outlook for the US economy and financial situation. It happened. But the 2003 to 2020 run can not be repeated. Now near 1%, there is little room for rates to drop further. Also realize this means you are stuck in an under 1% return world when it comes to bonds. But don't move to stocks since 1% will significantly beat the stock market the next few of years. The main point here is that over the long-term, interest rates determine whether the F fund is a better place to park your funds over the TSP G fund. Sitting near historic lows in interest rates I don't consider this a sound long-term bet. Go with the TSP G fund this bear market. A TSP Allocation Strategy Life-Cycle Funds The most basic TSP investment strategy - Buy & Hold - is employed by the TSP Lifecycle Funds. While it is true that it greatly simplifies investing, the TSP Lifecycle Fund is subject to real market risk - significant losses in bear markets - while limiting gains in bull markets as discussed below. The other issue is the inclusion of the TSP I fund as discussed above. You can do better. The Lifecycle funds are predominately invested in equities until you close in on retirement where they start shifting to the TSP G fund -- 74% in the retirement income producing fund. And in retirement you are exposed to the stock market risk during bear markets. The two ovals in the next chart highlight a key point about most Lifecycle funds. They lose less during bear markets, but the gain less during bull markets. This means they are less "volatile" and this is advertised as being less risky. With the exception of the Retirement Income Lifecycle fund you run the risk of large losses during bear markets as seen in the chart.

The Life cycle funds hold proportions of each equity fund (TSP C/S/I) based on their market value. Because the equity funds are diversified geographically across the developed world based on a value weighted basis, this geographic diversification under-weights global technology relative to holding the US only equity funds. With the addition of emerging markets to the TSP I fund, the increased market value of this fund means the Lifecycle funds will hold a higher allocation to the I fund and a lower allocation of the US equity funds. So to keep it simple we've now narrowed our decisions down to only three funds to consider - the TSP C and S equity funds and the no-risk G fund... (the one exception is to temporarily hold the F fund over the G fund during declining interest rates) ...let's take a look at The 3 Best TSP Funds today and why. |