-

-

-

About

-

-

avoid large losses

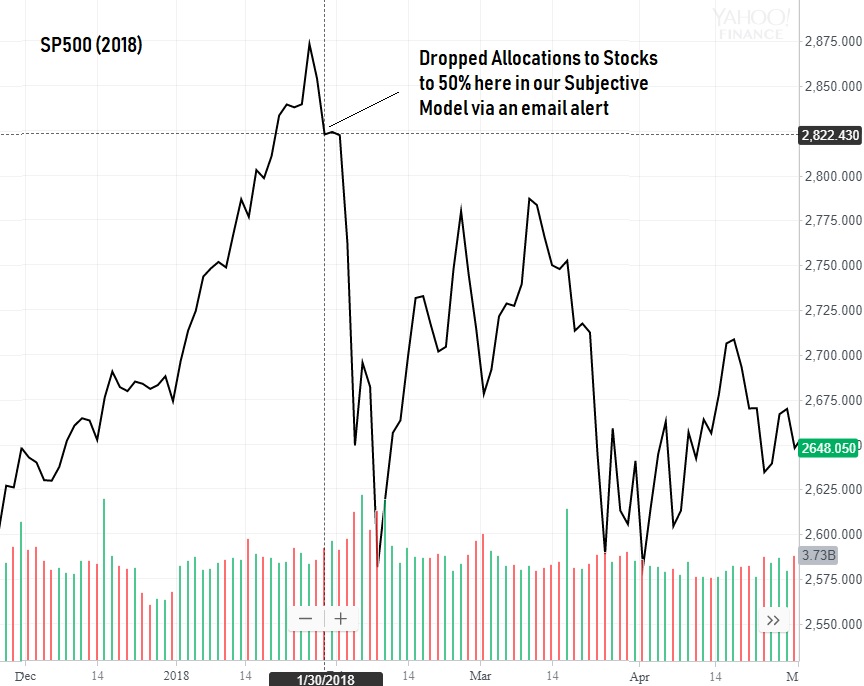

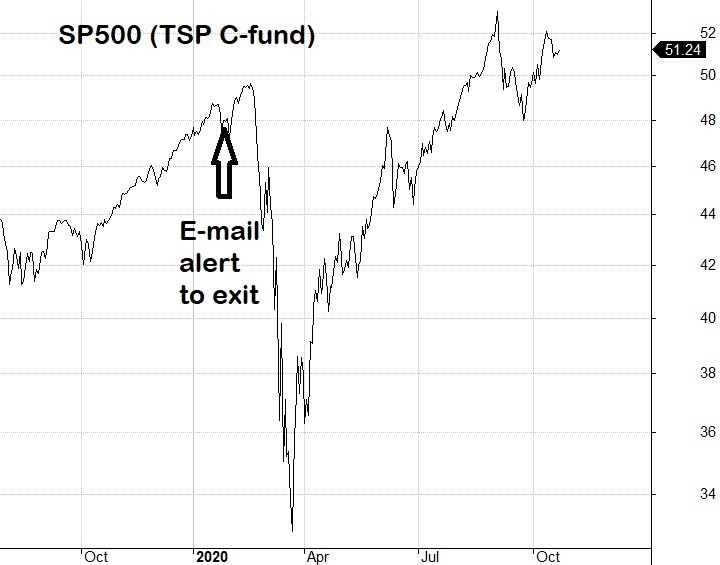

1) Bear Market Warnings

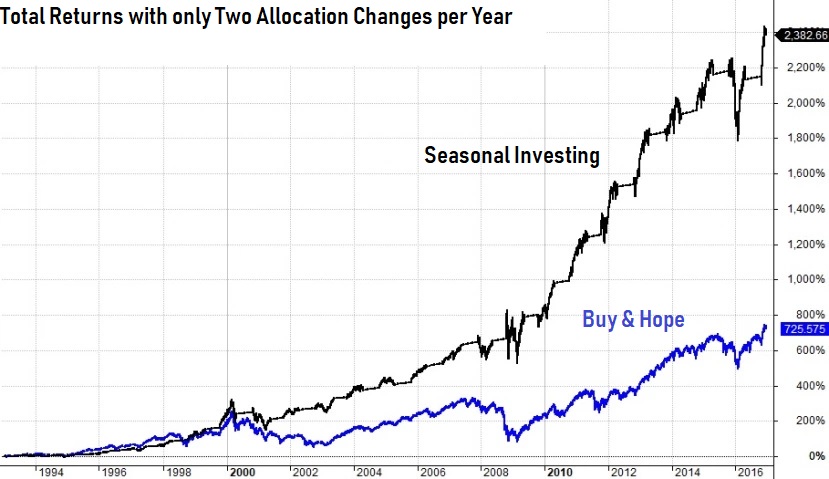

2) Reduced exposure to stocks during the unfavorable season

E-mail alerts Online Reports Almanacs

Testimonials

TSPSmart-I can’t read enough! You are saying all of the things I have been saying! I have been successful for quite some time at stocks, but starting last December, I lost my read of the market. Your writing is spot on and largely correct at guessing the future direction. Love the service. Naval aviator with an interest in finance…sounds familiar.

Sean XXXXX

Mr. Bond,

I was signed up with Sy Harding from March 2009 until his death. I told him once that I didn't know who was the smartest market adviser in the business but I was certain he was #2. I found TSP smart online last February and signed up. You have saved my six about five times in the past year. I'll be renewing and will keep trying to spread the word about your service. It is unreal how buy and hold has been sold to investors.

I believe I have finally found #1.

Best wishes for the new year and many more to come.

Don XXXXX

Please JOIN and start learning today.

TSP Allocation Advice for Serious & Reluctant Investors

No more guessing - know when to get in and out

No more guessing - know when to get in and out

- Receive simple-to-execute allocation change e-mail alerts

- Only requires 2 allocation adjustments per year with our lowest priced service

- Also recieve access to at least two summary reports per year on the markets

- Designed for all investors so you can focus on what matters in your life and not the markets

Know when to sit out Bear markets

Know when to sit out Bear markets

-

On average a new bear market begins every five years

-

The average bear market loss is 38% - the last two lost 48% and 56%

-

It takes a 100% gain to regain a 50% bear market loss

-

The financial news is most bullish at market tops and bearish at market bottoms

-

All levels of membership receive special alerts based on our market cycle indicators

Stop the noise - focus on market leading indicators

Stop the noise - focus on market leading indicators

- Online Situation Reports – Tracking market leading indicators

- Interim Updates – Market updates as required to market indicators and risks

- Special Alerts – When our market indicators indicate caution and time to exit the market

- For investors who want more information but without the noise

Increase your trading percentages with our Almanacs

Increase your trading percentages with our Almanacs

-

See the daily seasonal tendencies of your index funds with win-loss records

S&P 500 index (TSP C fund)

Small & Mid Cap fund (TSP S fund)

Fixed Income Fund (TSP F fund)

-

Boost your returns with low risk seasonal cherry picking trades

-

We broke out the bull market years from the bear years and it changed core seasonal myths

-

For serious investors who like to make their own trades

full service for less than the price of a cappuccino a week

A sample of our alerts