-

-

-

TSP S fund

-

-

-

-

TSP S fund

Table of Contents | The non-sp500 index fund What is the S fund?The TSP S fund tracks the performance of all the US stocks not in the SP500 index via an index called the Dow Jones Total US Stock Market Completion Index. For simplicity, we refer to it as the non-sp500 index. We also think of the "S" as Small, as in the Small Cap stocks. This index includes over small and mid-sized 3000 companies. While the index tracks 6 times as many companies, the market value of these smaller companies combined is only a quarter of the largest 500 companies comprising the SP500 index. To hold the total US stock market in a diversified allocation, you would need to allocate 4 parts to the TSP C fund and 1 part to the TSP S fund such as [80% C and 20% S] or [40% C and 10% S]. The future returns of the both the non-sp500 index and the SP500 index depend on its current valuation level. The SP500 swings in value relative to many measures during market cycles (bull and bear markets). Higher valuations (not the same as price) mean lower future returns. Many investors choose funds based on past returns. Past returns are at their highest near market tops and lowest at market bottoms. To compare the make-up of the major equity funds by sector weighting please review compare equity funds. |

TSP S Fund Performance Characteristics

One of the main take-aways I pass on about the TSP S fund is that while it tends to perform about the same as the TSP C fund in the long run, it runs hotter in rallies and dives deeper in corrections. This also applies to bull and bear markets as well as an annual seasonal pattern. By understanding this performance characteristic you can increase your investment returns by leaning on each fund at different times. You should also know something about why the small caps perform the way they do as compared to the large cap SP500 fund so you can watch out for special scenarios.

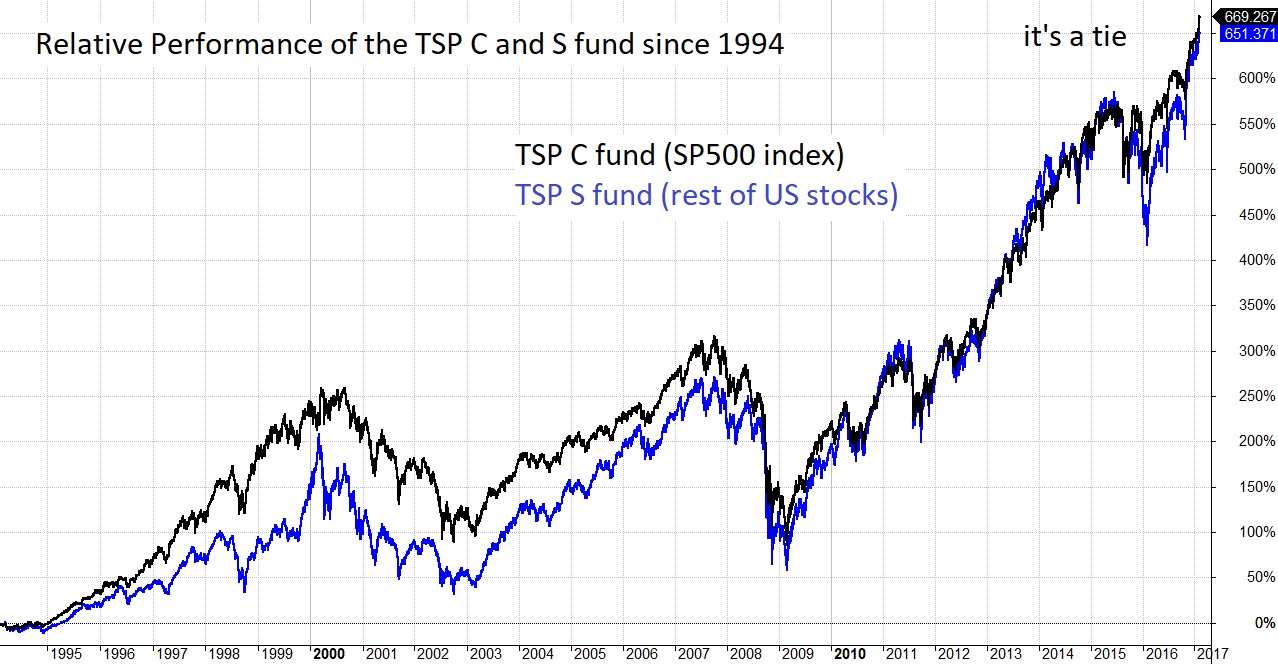

While this chart ends in 2017, it shows the relative performance of the S and C fund over 23 years was basically a tie. The Small cap funds tend to have larger moves up and down (volatility) than the large cap stocks in the SP500 index but their relative performance over a full market cycle (bull and bear market) are not too different. The best time to buy the small caps would be near market bottoms and as we approach the top move into large caps which are often the last to fall. This increased volatility of small cap funds (TSP S fund) makes it a better candidate of seasonal strategies because the small caps rise further in the favorable season for equities and decline more during the unfavorable season (summer & fall).

The TSP S fund started in 2003 near the bottom of a bear market. It's outperformance is one of chance having under-performed since 1994 when the index the fund tracks was first designed.

It helps to compare the TSP S fund to the TSP C fund to better understand it so we will discuss the SP500 (TSP C fund) here too. There is less information on the S fund as a whole, but enough to make some good decisions.

First, combined the TSP C fund and TSP S fund account for the bulk of US companies listed on US exchanges. The TSP C fund has around 500 of the largest US companies, hence the name SP500. The TSP S fund captures all the rest of the US stocks and this is why I like to call it the non-sp500 index for simplicity. In the late 1990s, there were over 12,000 companies in the US and now we are sitting with about 4000 of which 3500 are in the TSP S fund.

While the TSP S fund has 7x as many stocks, the total value of these companies is only around 20% of the total US stock market. The TSP C fund accounts for 80%. There are many SP500 funds outside of TSP, but there are few exactly like the TSP S fund - one is the Vanguard fund (VXF ETF) that tracks the same index. We use this to watch the real-time performance of the TSP S fund because ETFs trade like stocks.

If you look at the TSP Lifecycle funds you will note that among the equity funds, they each hold a percentage based on the market value of each index. The ratio between the C and S fund matches their values (4 to 1). If you hold a 50/50 allocation then you are over-weighting small caps. To hold the total US market, you need to allocate 4x as much to the C fund as the S fund.

While the funds hold stocks, we break down the composition into sectors for a better understanding of how each sector of the market is performing. There are sector funds outside of the TSP and some invest in these with Tech being very popular today. Here is a snap shot from 15 August 2021. Note the dividend yield of 1.24% for the C fund is extremely low due to the SP500's high price today.

S-fund C-fund

30-day SEC yield: 0.74% 1.24%

Sectors

Info Tech 22.6% 27.8%

Healthcare 14.3% 13.4%

Financials 13.9% 10.9%

Industrials 13.6% 8.4%

Consumer Discr 11.8% 12.1%

Real Estate 7.3% 2.6%

Comm Service 6.0% 11.2%

Materials 3.8% 2.6%

Consumer Staples 2.6% 5.9%

Energy 2.2% 2.6%

Utilities 1.9% 2.5%

While the sectors are close in composition between the two funds, no two companies exist in both funds. Facebook was moved to the Communication Services sector of the C fund. Combined the Communications Services and IT make up 40% of the SP500 value today. The old industrial sectors only account for 16% of the SP500 and 21% of the S fund.

One of the most important points I try to pass on is that the SP500 Tech Sector's revenue is 60% non-US revenue. For the SP500 overall, about 30% is international. The point is the SP500 is already geographically diversified and when one adds in the TSP I fund you are actually under-weighting the Tech sector because the TSP I fund only holds 6% Tech.

--------------------------------------

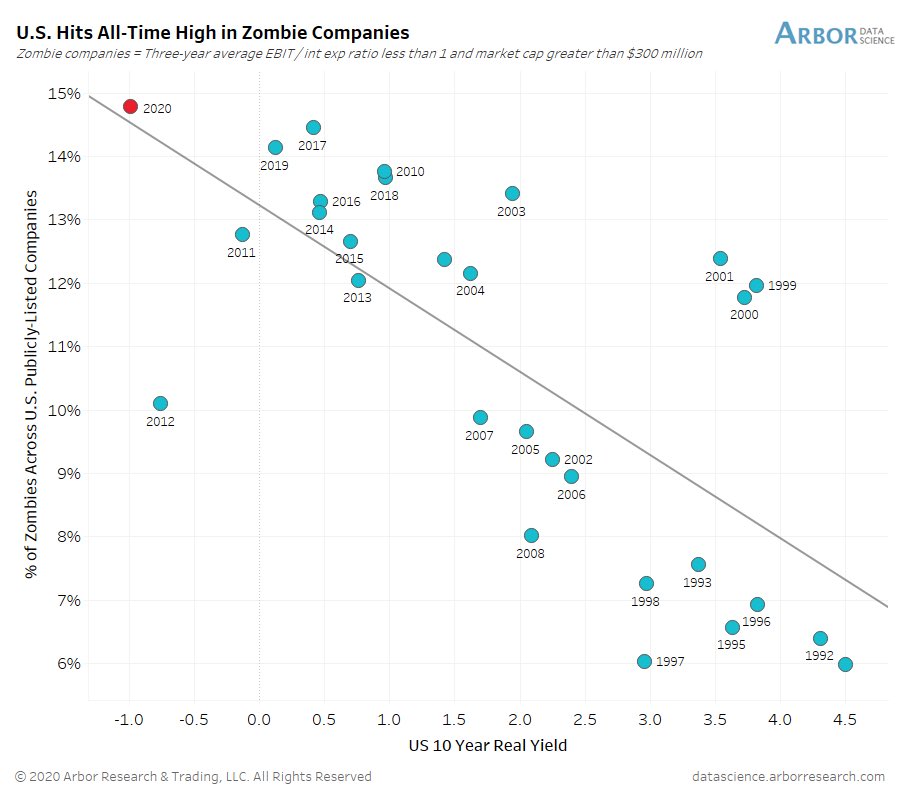

The Russell 2000 index includes the smallest 2000 companies in the TSP S fund. They make up 1/3 of its value. So let's look at this segment. I've seen many references to the number of zombie companies among the small caps. A zombie can not cover its expenses with cash flow and requires ever more borrowing. Some new companies have this issue and this is normal initially, but not for older companies unless they are in trouble. The risk of default for these companies is high. Remember, the first investors to get wiped out are those holding their stocks, then their subordinate bonds and lastly the senior bond holders (who also get the lowest yield).

At first glance it appears surprising that there would be more zombies as interest rates fall. But in fact, it is because interest rates fell these zombies have not already gone bankrupt. They are still weak. They still need to be restructured, but it was just delayed by cheap pandemic loans. And while their interest payments will not sink them, making payments on principle will once their cash levels run low again.

Performance:

Prior to COVID many of these companies were in trouble and they were only able to pay the billions by raising more money by issuing "junk" bonds and obtaining loans. The small caps were under-performing prior to COVID.

When the Federal Reserve unleashed 11 money printing programs and pushed money into the financial markets these same companies loaded up with more lower interest debt. This shot in the arm meant they had the cash to survive another few years... small cap zombie stocks shot up in price due to the removal of this immediate risk. We also saw forced buying by those who had bet on these companies going bankrupt - short selling means borrowing stocks to sell today and buy tomorrow.

When the Federal Reserve starts pulling back on liquidity in the markets, the small cap stocks will struggle again and fall further in a correction of bear market.

Analogy: If a person can not pay all the minimum payments on their credit cards and a new credit card shows up in the mail, they can now pay those minimum balances for a period of time. But they will be deeper in debt and their cash flow situation will end the charade at the point they can not get another credit card.

For a more in-depth comparison of the TSP S fund with the TSP C and TSP I fund please review our free TSP Allocation Advice.