-

-

-

-

-

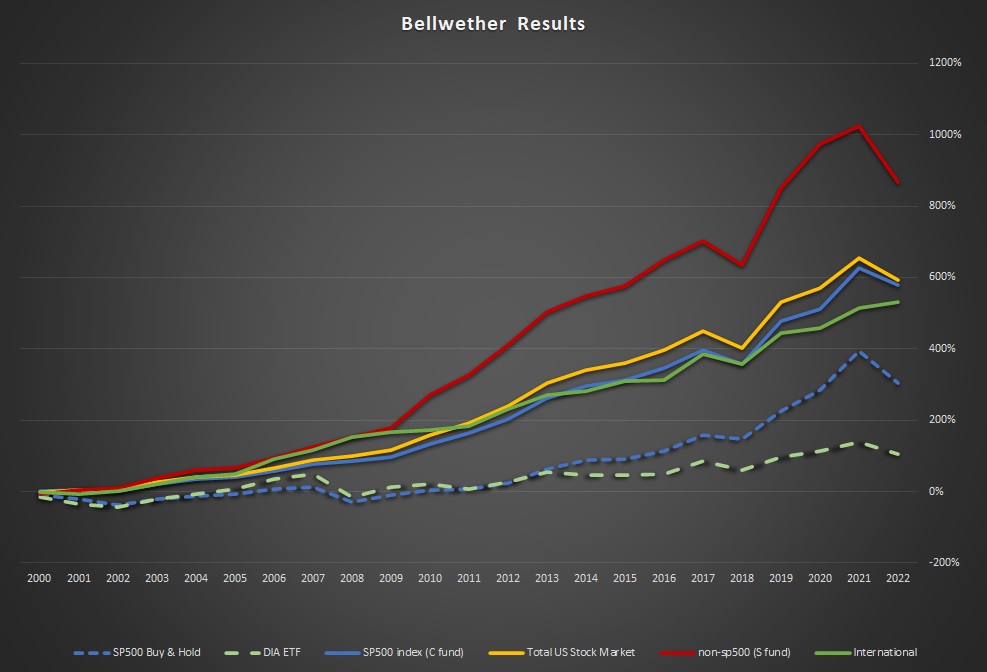

Bellwether Results

-

-

bellwether timing results

Seasonal Investing Over Two Market Cycles with the Bellwether signal

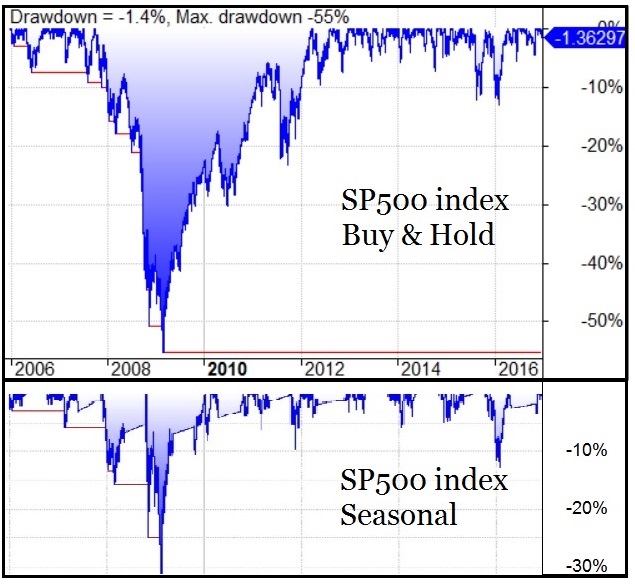

A picture is worth a thousand words...

But we still need words and tables to explain how this happens

For the lengthy description of the Bellwether formula please read Our Results page. To keep it simple, the Bellwether is a simple-to-execute seasonal strategy that exists the market for what is called the unfavorable season for equities which begins sometime in the Spring and ends in the Fall. Most of the largest market draw downs occur during this period. By sitting in safe funds during this time, over the full market cycle the simple strategy beats buy and hold.

Small company stocks are more volatile and this makes them better candidates for the seasonal strategy too. Since they pullback more in the summer and gain more in the winter.

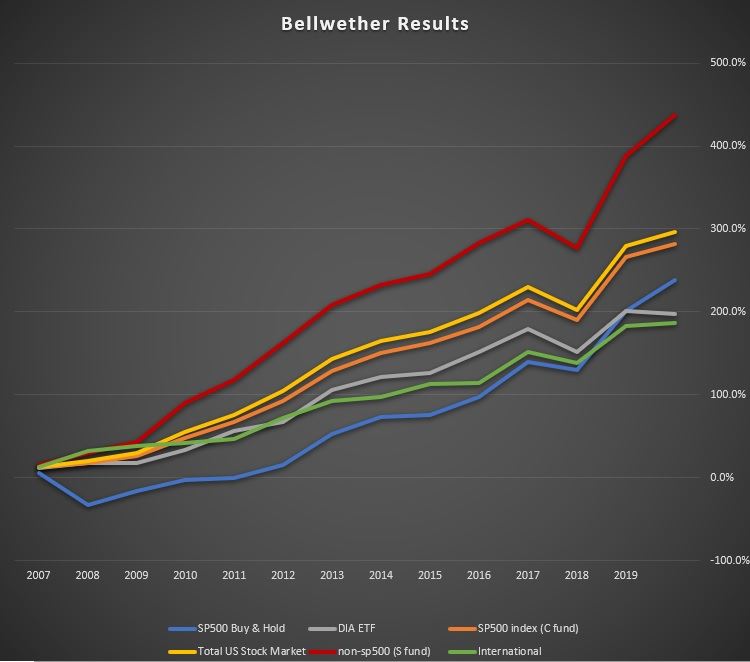

The market cycle since 2007 market top has been like no other with the central banks intervening in the markets during pullbacks. Has this affected the seasonal strategy? Yes. Since many of the pullbacks occur in the summer, their interference in the free markets during this time has caused the stock market to record some of the best "unfavorable season" returns. But we find the strategy still works. And should payoff during the next bear market.

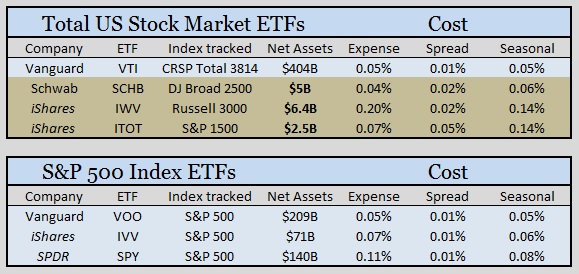

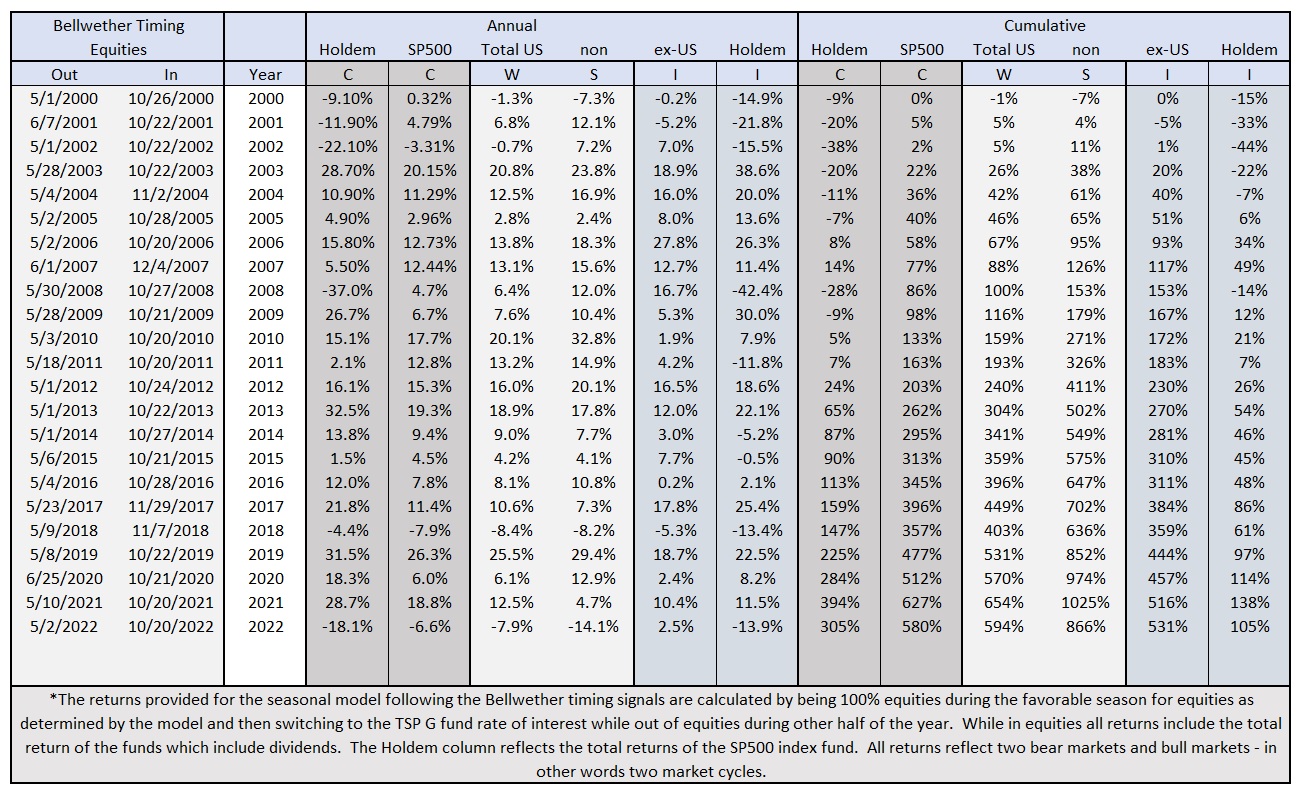

You can look at our detailed individual fund pages to learn more, but here we combined all the results into two charts and several tables. The results are based on the Bellwether timing signal meaning all the funds move into equity funds on the same day each Fall and out on the same day each Spring. Our Bellwether timing signal uses the Total US Stock Market to determine the favorable time of the year to be in stocks.

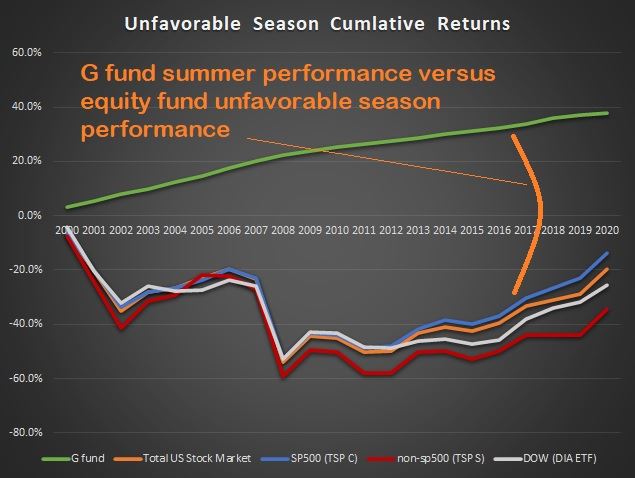

Let's look at the reverse seasonal effext by looking at what we miss if you were only invested during the unfavorable half the year. For those without TSP accounts, the TSP G fund is similar to a Prime Money Market fund. Since the seasonal strategy is in the stock market during the winter, its returns in this time are the same as the stock market. So it is the summer returns that set it apart from buy & hold. The TSP G fund does not return much during those 6 months of the year, but it does add to returns whereas the stock market has set backs many years. And overtime this adds up - negatively.

Avoid stocks in the unfavorable season

Please note that our strategy only requires two allocation changes per year in order to avoid the unfavorable half of the year for stocks. It is an advanced Sell-in-May strategy built off the work of Sy Harding and optimized for any SP500 index funds and small cap funds (TSP C and S fund). To learn more about the timing signal, please review Bellwether's Timing Signal.

Bellwether increases returns by reducing risk, not increasing risk

The chart above only shows the draw downs of the market following a buy and hold strategy and a seasonal strategy. From this perspective, we can see seasonal investing reduces investor stress levels along with providing higher long term returns. There have been two bear markets like the one seen above since 2000. We are due for another bear market. Are you ready?

The Details

What you see below shows what happens to your long term returns when you avoid taking the large losses that historically hit the market during the summer and fall. The chart below have the individual year returns and the cumulative returns since 2000 using this simple-to-execute strategy. The bottom-line is that following our Bellwether timing signal increased the SP500 index funds return from 147% to 362% total return since the beginning of 2000. The small cap funds do better thanks to their larger seasonal volatility.

The Bellwether Results

-

Bellwether Results