-

-

-

-

Our Timing Models

-

-

-

Our Allocation Models

We have two basic allocation models to assist you in allocating your retirement funds. The first allocation model is our objective seasonal Bellwether Allocation Model that uses the total US stock market to generate a timing signals to signal the beginning and end of the favorable half of the year for investing. Our second model is our subjective Expedient Allocation model which is informed by our first model but allows for deviations based on other factors.

I. Bellwether Allocation Model

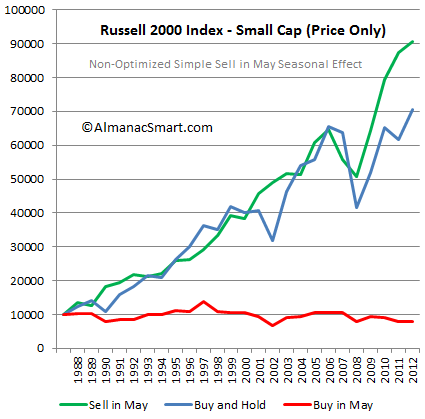

Our primary allocation model uses a formula-driven objective strategy based on 60 plus years of historical seasonal price data. "Seasonal price data" refers to the average annual price pattern of the stock market over the course of the calendar year. The following chart highlights the difference in performance of two halves of the year in the small cap Russell 2000 index. The green plot is the favorable six months and the red plot is the unfavorable six months. The blue line shows what the passive investor earned. What is missing from this seasonal model are the extra returns from investing in safe interest bearing funds during the half of the year the model sits out of stocks.

Focus on the red line in the chart above.

If you bought the Russell 2000 index on 1 May and held it 6 months each year from 1988 until 2013, your return would have been negative. All of the market's gains occurred during the favorable season for the stock market - November through April - once averaged out. Many investors find this information shocking, but the market's seasonal effects have been widely reported in academic research.

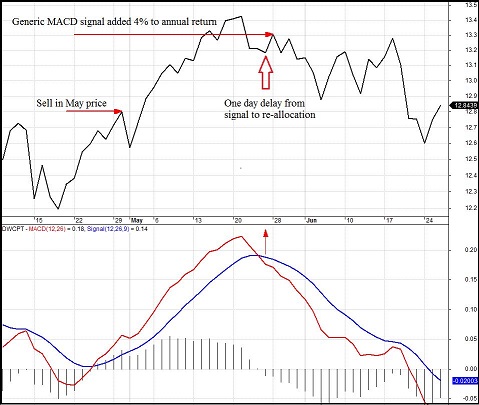

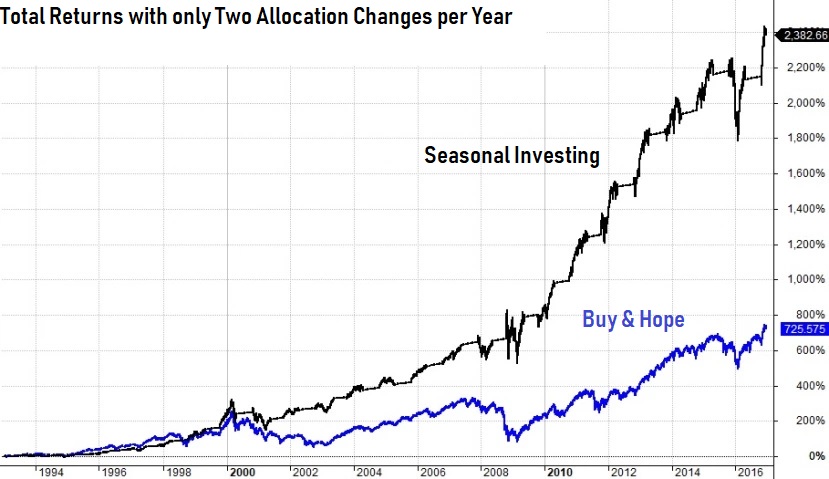

Our Bellwether Allocation Model is an advanced seasonal model that uses a refined investment window twice per year (as opposed to the 1st of the month in May and November) and then follows a technical market trend indicator to provide further adjustments for each individual year.

Our technical indicator adjusts to the current year's market trend

This model goes 100% in and out of equity funds for tracking purposes and the results can be viewed on our Bellwether Results page. You can think of the Bellwether more as a timing model that signals the beginning and end of the favorable season for stocks each year.

II. Our Subjective Expedient Allocation Model

It became evident early on that a simple seasonal model did not answer a few basic questions such as "which funds should I invest in this year" and "what should my allocation percentage be."

Because of this I created the Expedient Allocation Model that basically follows the Bellwether Timing Signal, but allows me to deviate from the formula-driven signal when other factors should be part of your investment decision. The most basic question is which fund to invest in which typically comes down to either allocating to large company index funds or the small company index funds. Small cap funds exhibit greater seasonal tendencies, but large cap funds are safer when market risk is elevated.

The other major decision is how much to allocate to equities versus safe funds. Many investors today do not understand the risk inherent in holding stock funds at certain times. While the seasonal timing eliminated much of the previous two bear market losses, there are times it is prudent to sit on the sidelines regardless of the time of the year. We track other indicators outside of the stock market that are highly correlated to near-term stock market losses.

Simply put, we do not believe market risk is uniform across time as modern portfolio theory ascribes to in order to keep investors fully invested in fee-earning funds. When market valuations are elevated AND market risk becomes elevated we recommend lower allocation levels to equity (stock) funds to include exiting the stock market completely.

Communicating

If I did not provide this subjective model, you would simply get two email alerts per year telling you when to enter and exit the market. The Expedient Allocation Model provides a communication vehicle for me to explain what else is going on in the investing universe that you need to be aware of. You can follow our Expedient model knowing that it is informed by the Bellwether timing or you can simply follow the straight seasonal timing with the funds of your choosing.

Educating

I may go a year or two with only basic timing alerts, then you may see a flurry of email alerts as danger signs begin to appear. You do not need to tune into my website's market commentary if you only want to be warned of danger. You will receive allocation change recommendations and warnings via e-mail. But if you are interested in learning what is driving the markets I try to educate my subscribers along the way with key information from many sources as it hits my radar.

Background

I obtained a degree in Investment Finance, but chose a life in the Air Force first and I am glad I did. But I never lost interest in the markets and later found I had some unlearning to do about how the markets really work. I have been wading through research, fake research, market analysis for over 30 years now. I know BS when I see it and I know who is honestly trying to understand and write about the economy and the markets. My view is that long before there was fake news, there was financial news.

There is a reason why retail investors are all-in at market tops and the least allocated near market bottoms. I am not trying to cherry pick the market top or bottom, just get you out near the top and back in near the bottom and avoid the bull market corrections along the way with our seasonal strategy.

Goal

My primary goal is to help you make more informed allocation decisions so you can retire with the largest nest egg possible. And that requires a long-term focus and not short-term return chasing.

Your next stop should be our Bellwether Results page to see how our objective strategies signals have worked out for most of the major index funds.