-

-

-

TSP F fund

-

-

-

-

TSP F fund

| Table of Contents |

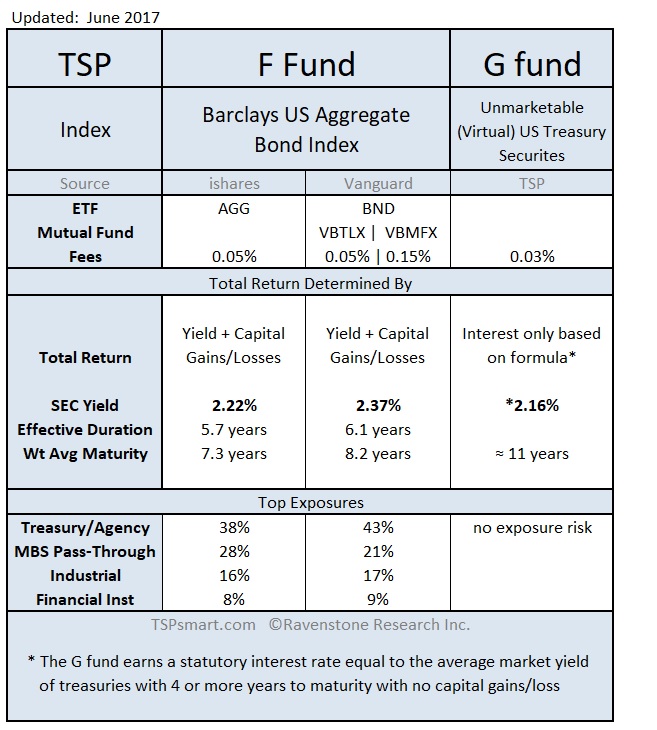

What is the F fund?The Bond fund (Fixed Income) The F Fund is designed to match the performance of a Total U.S. Aggregate Investment Grade Bond Index, a broad index representing the U.S. bond market. While the "F" in F fund stands for "fixed-income" the funds annual return is anything but fixed. A bond fund's price changes based on yields earned and capital gains or losses as interest rates fluctuate. The table below gives you an approximate picture of the securities the fund is invested in. In the short-term, this fund's price moves opposite of interest rates. If interest rates rise, the fund sustains small capital losses and if interest rates climb, the fund sustains small capital gains. There is a fairly simple longer term formula for determining returns. Since the average duration of the fund is about 5.4 years we can apply a little math to determine the fund's expected return. Over the next 5.4 years the fund's expected return will be real close to its current yield. This is because over that time horizon any change in yield will be offset by capital gains or losses. So a current yield of 2.6% implies an average annualized yield of 2.6% for the next five years. The bottomline is once interest rates are low, the TSP F fund can not achieve the same returns as when interest rates were higher whether we look at yield only returns or total returns. Below we go over how to calculate short term capital gains in the TSP F fund. |

Compare the TSP G fund and TSP F fund

Why does the F fund show higher past returns?

Since the inception of the TSP F fund interest rates have been declining. This allowed the F fund to capture the capital gains that come with bonds when interest rates drop. The TSP F fund's yield has always remained close to the TSP G fund's only source of income, its interest rate.

Since the inception of the TSP F fund and the index it tracks, US interest rates have been trending down and providing capital gains to the fund. As we approach very low interest rates, this benefit is diminished.

TSP F Fund Future Returns

Everyone wants to look at past returns when picking funds - what is the funds 1-year, 3-year, 5-year return? The point of this section is to show that not only do past returns do not matter, but that we can come pretty close to predicting the 5-year future returns of the F fund. Here is a little rule:

The annualized future return for the TSP F fund over the next 5 years is close to its current yield.

Three examples: 1) If the yield remains unchanged, there are no capital gains or losses and you your only income is the current yield. 2) If interest rates rise, the higher yield you will receive will be offset by capital losses over those 5 years. 3) If interest rates decline you will receive capital gains, but the capital gains will be offset by a lower yield.

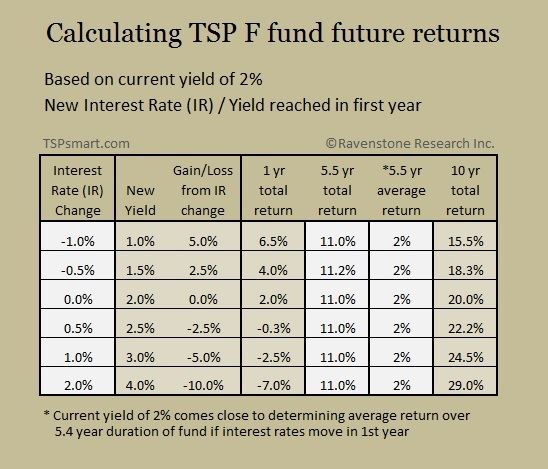

With an approximate 5 year effective duration of its underlying securities we can apply a simple rule to calculate the TSP F funds capital gains or losses. For each 1% movement in interest rates, the fund's price moves opposite by 5%. The only time the TSP F fund would outperform the TSP G fund is during the time interest rates are dropping.

The historic low in 5-year treasuries interest rates was 1.2%. If the F fund yield drops this amount again, that would provide a 5% capital gain with very little yield going forward. In the chart below, we start with an approximate current yield of 2%. The first column represents a change in interest rates in the near term. The second column is the new yield and the third column is the capital gain or loss incurred as the result of the change in the current market's interest rate. Then we can calculate the future returns for each scenario for 5.5 years and 10 years. The 5.5 year annualized return is always the current yield in our example. Note: In this example our yield changes in the 1st year then holds steady.

As seen in the fourth column, the F fund can only beat the G fund during the time interest rates are falling. For interest rates to drop significantly going forward would require a deflationary period due to a slowing global economy. This is not out of the question and we are currently seeing negative interest rates in Europe and Japan. But this is the opposite direction the Federal Reserve hopes to go.

Another important point to understand is that if interest rates drop 1% the first year, not only does the F fund have a lower yield built in it also has a negative 5% capital loss waiting as it moves back to its original 2% yield. The best outcome for us would be for interest rates to normalize to a higher level soon so we can earn a descent yield in either the TSP F or G fund assuming inflation remains the same.

You do not want to be invested in the TSP F fund while interest rates are rising whenever this occurs. The great benefit of the G fund is that we immediately get to enjoy the benefits of the higher rates without incurring the capital losses.