Best TSP Allocation and Strategy for 2020

TSP Strategy

Simplify your decision

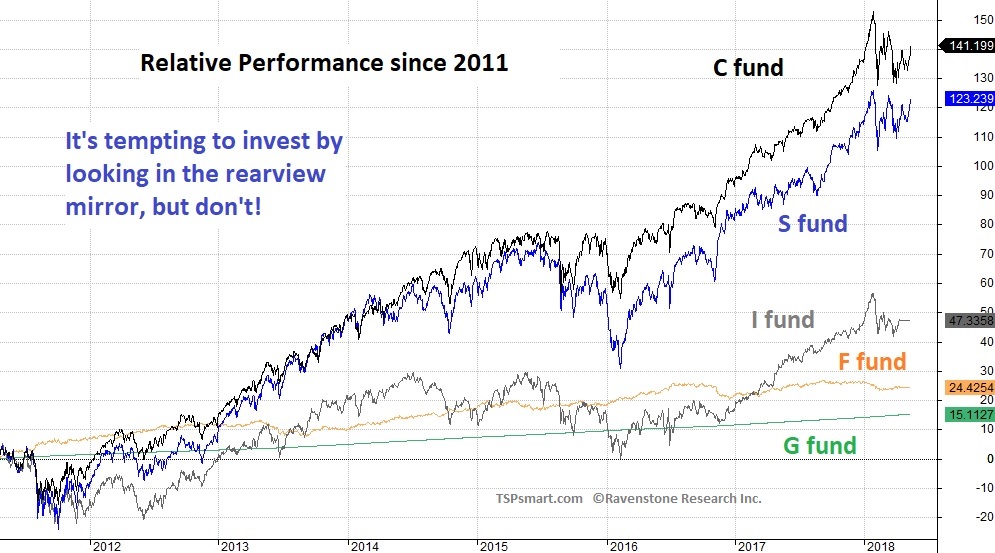

Updated December 2019 This free guide simply highlights some of the basic realities that are left out when marketing material and commission seeking managers try to sell academic theory to simplify their jobs while increasing their fees. This is not rocket science. It just takes time to research which is not something most investors have. This 15 minute guide will save you a lot of time and hopefully increase your future returns. The top concepts you should understand before setting TSP allocations: 1) Why has the TSP I fund significantly UNDER performed this cycle and may the next one. 2) How are the TSP C and S fund performance correlated, and can you take advantage of their different patterns. 3) Why you should spend more time in the TSP G fund rather then the TSP F fund when seeking safety. 4) What is your most important decision in allocations and why all others pale in comparison. 5) While you should not market time based on valuations, market valuations do determine future long-term returns. 6) While market timing is a bad idea, market cycle considerations is critical to preserving your nest egg. -- the last bear market gave up 110% of the previous bull market gains in short order... it matters. ______________________________________________________ Chasing past returns is not a good long-term strategy Do you drive your car by looking in the rear-view mirror? You should not invest that way either - stop looking to past returns to determine where to invest in the future.

Look Forward There are five basic funds in the TSP that one can allocate to plus the Life Cycle funds that allocate among the basic five funds based on your years to retirement using an academic portfolio theory. We will talk about the Life Cycle funds below but first we need to focus on the five basic funds. We can do a pretty good job determining the winners going forward long-term based on what's under each fund's hood. Let's start by eliminating the less desirable funds from the mix. Comparing the two low-risk funds With one exception I consider the TSP F fund the less desirable low-risk fund for long-term investors at this point in history. The difference in performance of these two funds are the capital gains or losses the F fund sustains during the year due to interest rate movements. Unless interest rates are falling and the F fund price is rising, there is no reason to be in the F fund over the G fund since the G fund interest rate closely matches the TSP F fund's yield alone. This may explain why the TSP Lifecycle Income Fund for retirees currently holds 74% G fund and only 6% F fund. From the F fund’s inception until 2012, interest rates were declining and the F fund’s price went up due to the falling rates. While this makes the F fund’s past performance look good when comparing it to the G fund, this has not been the case since 2012. Since 2012 interest rates have put in three bottoms, one in 2012-13, then 2016 and recently in 2019. The TSP F fund price has been on an interest rate roller coaster since 2012. .

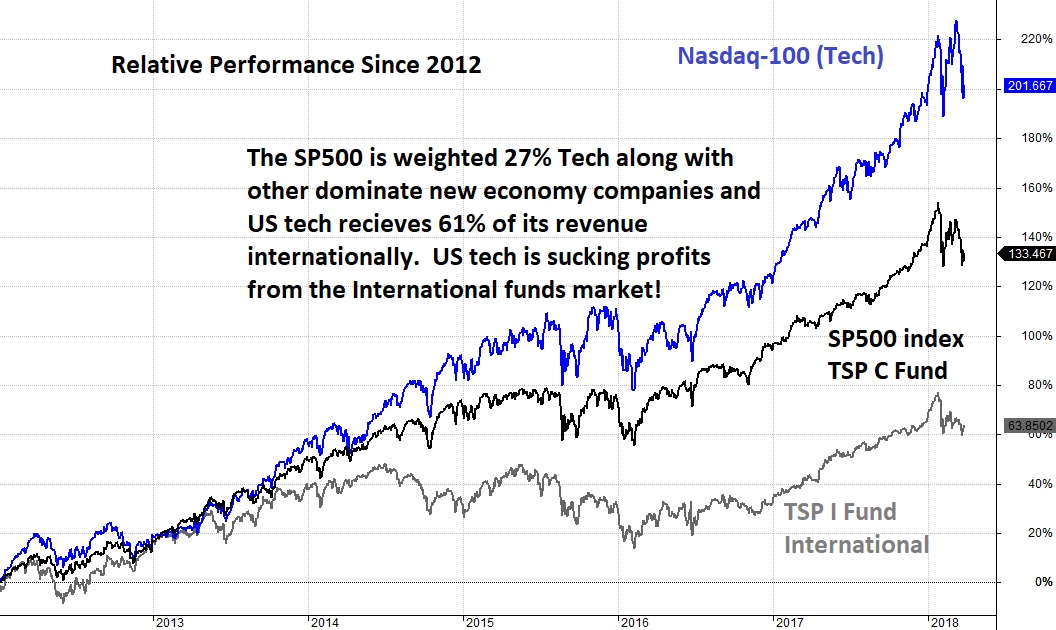

We saw downward pressure on interest rates in 2019 due to a slowing global economy and increased financial stress. Holding the TSP F fund at the end of 2019 is a bet that interest rates in the US will plunge to record lows which implies a negative forward outlook for the US economy and financial situation. It could happen. The main point here is that over the long-term interest rates determine whether the F fund is a better place to park your funds over the TSP G fund. Sitting near historic lows in interest rates I don't consider this a sound long-term bet. Short-term can be a different story. It is important to understand that you will often see short term bounces in the F fund when the stock market sells off. Investors are simply running to safety and this causes a very short-term bump in the safer fixed income prices. This does not occur for the TSP G fund because it does not hold real securities - it is a virtual fund and its interest rate is based on a formula. When investors return to the stock market, the bump in the TSP F fund often disappears. So for long term investors, the trend in interest rates is what matters. Last year I said the trend of declining interest rates bottomed in 2016 and was set to move higher through 2020 or at least until the next financial crisis. 2019 ended with elements of a financial crisis in the repo markets (the banker's overnight bank). The plunge in interest rates this year (rise in F fund price) was the result of global financial stress. So if you expect another financial crisis, does this mean the TSP F fund will become a better performing fund. Yes, but be careful. Bond funds come with both interest rate risk and default risk, the default risk during financial crisis means you should return to the risk-free TSP G fund after interest rates bottom. The bottom-line is when looking for safety during financial crisis's or bear markets, there is no better fund than the TSP G fund. Forget the international fund (TSP I fund) this market cycle Take a look at the TSP I fund performance since 2012 compared to the TSP C fund (SP500 index). Let's look at the reasons why it under-performed. Note: I define a "long-term investor" as someone who does NOT chase short-term movements in the market. An investor, not a speculator.

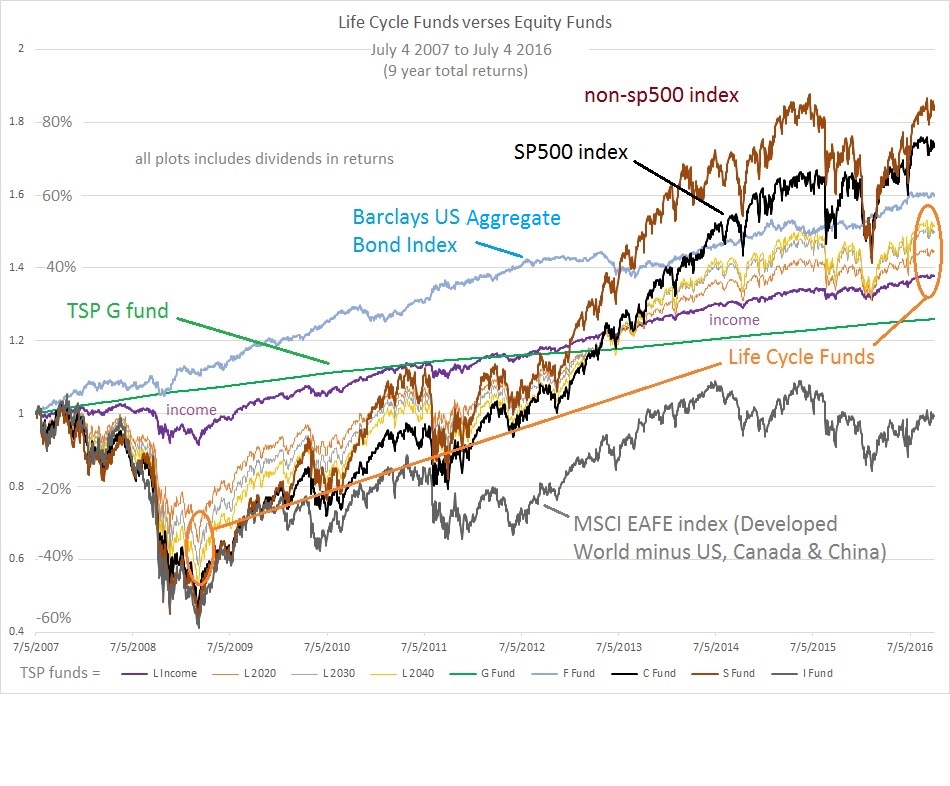

The other fund that long term investors should avoid for now is TSP’s International fund. The I fund is transitioning to broader international exposure in 2020. There is an ongoing battle between some Senators and the TSP managers over the inclusion of China into the TSP I funds portfolio and currently the TSP managers signaled they are going ahead with the expansion. This is not why I do not recommend the I fund, but it does add to the case a bit. The TSP International (I) Fund will now include more emerging markets the largest being China. Adding emerging markets does compliment the TSP US equity funds from a geographic diversification point-of-view. But diversification into under-performing sectors is not a benefit and remains the same with the new index it may track. While I expect Chinese companies to suffer under the trade war, the biggest problem is the lack of rigorous accounting and oversight in China. Many Chinese companies will not be standing after the next global financial crisis. This has more to do with financial falsifications than a simple recession. Chinese companies are stating cash and other assets they do not have. One of their top auditing agencies has been caught knowingly signing off on fraudulent accounting records. Not to over-state China, its contribution to the I fund should top out around 7% in the near term. The best performing sector in world has been technology and this is the primary weakness of the TSP I fund. And guess where the world’s preeminent tech companies are listed? They are listed in the US where their returns are captured by the SP500 index which is tracked by the TSP C fund. The International index (TSP I fund) is weighted with only 8% tech compared to the TSP C fund's 20% weighting. It is those top 100 largest Nasdaq listed companies that are tracked in the SP500 index that helped the TSP C fund pull ahead of the TSP I fund. These are the most profitable growth companies in the developed world and they sit in the TSP C fund. The SP500 companies as a whole obtain 31% of their revenue outside the US, meaning the SP500 is already diversified internationally. Better yet the SP500 tech sector obtains 57% of its tech revenue outside the US. When you add the I fund to your allocations, you are quickly under-weighting the world's large tech stocks. The TSP I fund is also holding over a 24% weighting in financial stocks and frankly Europe’s banks and finances are a bug looking for a windshield. The European Central Banks manipulation of interest rates into negative territory merely covered up the European problems in the short run with little positive effect on their economy. If interest rates do not rise above inflation, European savers will be crushed and the demand-side of the economy will suffer. Simply put, I do not see the TSP I fund as a good long-term investment for 2020 and beyond. While the US stock market is more over-valued today, the global stock markets were highly correlated to the downside during the last two bear markets - meaning you can not hide in international stocks when the US stock market rolls over into a bear market. Adding emerging markets adds an additional risk to the I fund. My concern on emerging markets are the lack of protections for investors in some markets which may be needed but not there during another financial crisis. A side note on the TSP Lifecycle Funds Should I invest in the TSP Lifecycle funds?The TSP Lifecycle funds follow a buy and hold strategy and are simply invested in all five basic funds to include the two we think should be eliminated from the mix. The funds are predominately invested in equities until you close in on retirement where they start shifting to the TSP G fund -- 74% in the retirement income producing fund. The two ovals in the next chart highlight a key point about most Lifecycle funds. They do lose less during bear (down) markets, but the gain less during bull (up) markets. This means they are less "volatile" and this is advertised as being less risky. With the exception of the Retirement Income Lifecycle fund you run the risk of large losses during bear markets. You also get the under-performance of the two worst funds during bull markets. You can do better.

The Life cycle funds hold proportions of each equity fund (TSP C/S/I) based on their market value. While the equity funds are diversified geographically across the developed world based on a value weighted basis, this geographic diversification under-weights global technology relative to holding the US only equity funds. With the addition of emerging markets to the TSP I fund, the increased market value of this fund means the Lifecycle funds will hold a higher allocation to the I fund than before and a lower allocation of the US equity funds. Note: I will share a link at the end of Part 3 with more details on the Lifecycle funds for those interested. So to keep it simple we've now narrowed our decisions down to only 3 funds to consider - the TSP C and S equity funds and the no-risk G fund... (the one exception is to temporarily hold the F fund over the G fund during declining interest rates) ...let's take a look at The 3 Best TSP Funds today and why. |

|