Become a member today

to have access to the Member's only pages!

Return to the Dashboard

Testimonials

TSPSmart-

I can’t read enough! You are saying all of the things I have been saying! I have been successful for quite some time at stocks, but starting last December, I lost my read of the market. Your writing is spot on and largely correct at guessing the future direction. Love the service. Naval aviator with an interest in finance…sounds familiar.

Sean XXXXX

Mr. Bond,

I was signed up with Sy Harding from March 2009 until his death. I told him once that I didn't know who was the smartest market adviser in the business but I was certain he was #2. I found TSP smart online last February and signed up. You have saved my six about five times in the past year. I'll be renewing and will keep trying to spread the word about your service. It is unreal how buy and hold has been sold to investors.

I believe I have finally found #1.

Best wishes for the new year and many more to come.

Don XXXXX

Sample Alerts

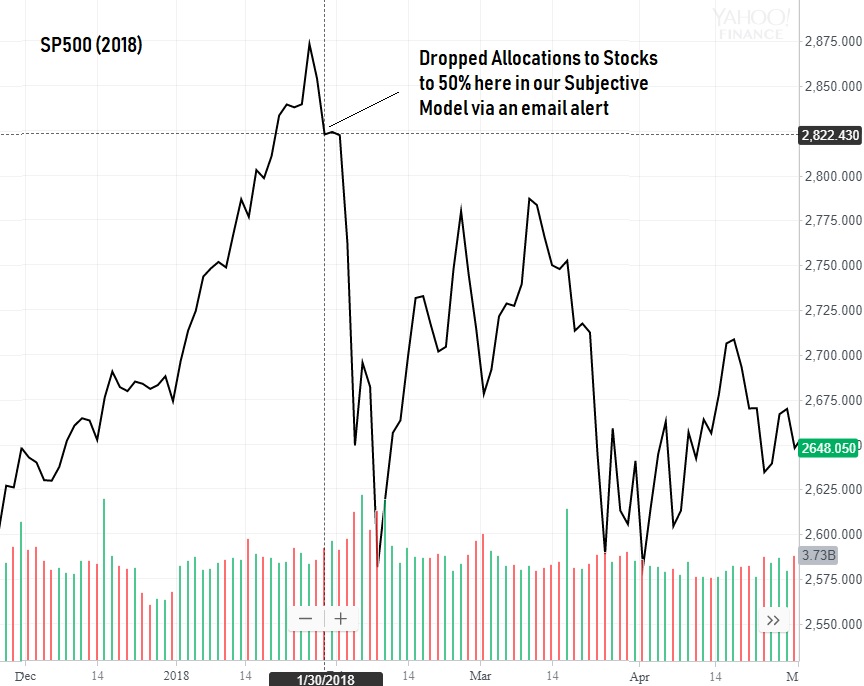

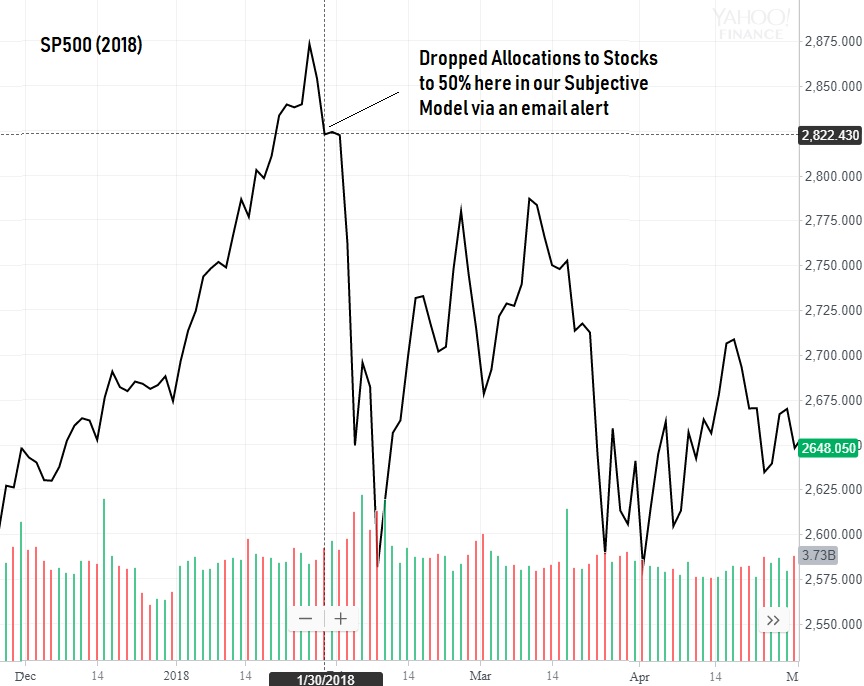

on 30 January 2018 via email alert...

I am reducing our allocation level to 50% in my subjective timing model on 31 January 2018.

Discussion: Our risk indicator remains in the Safe Zone. Stock market internals are fine, so why the shift?

Parabolic moves in the stock market are not normal and once they stop advancing they give back much of their gains. This parabolic is pulling back.

our 18 August 2015 interim update warned ...

Market internals remain weak and have for some time. Aversion to risk as measured by credit spreads in the bond market have now reached levels that historically been met with significant market corrections ... in the stock market within weeks.

Note: Our models were already out of stocks in August but we sent the email alert as advertised.

our members avoided significant losses...

again in our 14 December 2015 Special Timing Report we warned...

...our risk aversion indicators are indicating a potential market crash anytime in the next few weeks.